Dive into our latest articles, offering in-depth coverage of industry news, exciting new fintech startups, and the latest updates from Your Fintech Story.

-

AI, Growth, and Trust: Signals from Global CEOs for Fintech

February 10, 2026PwC’s 29th Global CEO Survey brings together perspectives from 4,454 CEOs across 95 countries and territories, spanning a broad range of industries and company sizes..

-

Duna Series A funding and what it means for business identity

February 5, 2026Duna has raised a 30 million euro Series A led by CapitalG, the growth investment arm connected to Alphabet. This brings its total funding past.

-

Corpay Agrees to Sell PayByPhone as It Refines Its Focus

February 5, 2026Corpay announced an agreement to sell PayByPhone, its mobile parking payments business, as part of a move to concentrate more tightly on its core corporate.

-

EnFi raises $15M and banks are paying attention to AI in credit teams

February 5, 2026EnFi, a Boston-based company building AI agents for commercial lending, has raised $15 million in Series A funding. The round includes investors connected to more.

-

Klarna backs Google’s Universal Commerce Protocol

February 4, 2026Klarna announced it is backing Google’s Universal Commerce Protocol, known as UCP. The goal of UCP is to create a shared way for AI agents,.

-

Airwallex Begins Official Launch in Germany

February 4, 2026Airwallex, the global financial platform originally founded in Melbourne in 2015 and now based in Singapore, has launched operations in Germany as of early February.

-

Tapi’s $27 M Series B and What It Means for Payments in Latin America

February 4, 2026Tapi, a Latin American paytech founded in 2022, announced a $27 million Series B round led by Kaszek, with participation from Endeavor Catalyst and Latitud..

-

Incard raises £10M to build a financial operating system for digital businesses

February 2, 2026London-based fintech Incard has raised £10 million in a Series A round led by Smartfin, with participation from Founders Capital, MountFund, and angel investors. The.

-

Talos Extends Series B to $150 Million with Strategic Investors

February 2, 2026Talos, the New York based institutional digital asset infrastructure provider, announced a $45 million extension to its Series B round. This brings the total Series.

-

Memcyco: $37M bet on stopping fraud before it happens

February 2, 2026Memcyco, an Israeli cybersecurity company founded in 2021, has raised $37 million in a Series A funding round to expand its pre-emptive fraud defence platform..

-

Rogo raises $75M to scale AI inside investment banking

January 30, 2026Rogo has raised a $75 million Series C round, bringing total funding to more than $165 million. Alongside the raise, the company announced the opening.

-

Mastercard Agent Suite: Turning Agentic AI Readiness Into Reality

January 28, 2026Earlier this week, Mastercard announced Mastercard Agent Suite, a new offering designed to help enterprises prepare for and deploy agentic artificial intelligence. The focus is.

-

Revolut Opens Full Banking Operations in Mexico

January 27, 2026Revolut has launched full banking operations in Mexico, becoming the first market outside Europe where the company operates as a fully licensed bank. The new.

-

How Jelou Is Scaling Conversational AI for Transactions After a $10M Series A

January 27, 2026Jelou, a company building transactional AI inside messaging apps, announced a $10 million Series A round to accelerate product development and international expansion. The round.

-

PayPal Bets on Agentic Commerce with Cymbio Acquisition

January 26, 2026Earlier this month, PayPal announced it would acquire Cymbio, a commerce orchestration platform that helps brands sell across emerging AI-driven channels. The deal is more.

-

Pomelo’s $55 Million Series C and What It Signals for Fintech in LatAm

January 23, 2026Pomelo, an Argentine fintech focused on payments infrastructure, just closed a $55 million Series C round led by Kaszek and Insight Partners, with support from.

-

Cloover’s €1.04 Billion Financing Commitment and What It Signals for Climate Fintech

January 22, 2026Berlin-based climate fintech Cloover has secured a €1.04 billion financing commitment, combining €18.8 million in Series A equity with a €1.02 billion debt facility. The.

-

AI in UK Financial Services: Progress Without a Safety Net

January 20, 2026In January 2026, the UK Treasury Committee published a detailed report on the use of artificial intelligence in financial services. Its conclusion is blunt: AI.

-

Polygon Labs Expands into Licensed Stablecoin Payments with Strategic Acquisitions

January 20, 2026Polygon Labs announced in January 2026 that it has agreed to acquire two U.S. crypto firms, Coinme and Sequence, for more than $250 million in.

-

Revolut’s Expansion into Peru: What’s Happening Now

January 20, 2026On 19 January 2026, Revolut announced that it has applied for a full banking licence in Peru. The company also confirmed the appointment of Julien.

-

WeLab’s $220M Series D: A Strategic Capital Boost for Pan-Asian Fintech

January 19, 2026WeLab, a Hong Kong-based fintech platform, has closed a US $220 million Series D strategic financing. It is the company’s largest round to date and.

-

Alpaca’s $150m Series D and What It Signals for Fintech

January 15, 2026Alpaca has raised $150 million in a Series D round, valuing the company at $1.15 billion and pushing it into unicorn territory. The round was.

-

PayPal Backs Klearly’s €12 Million Series A

January 14, 2026European fintech funding opened the year with a notable signal: PayPal Ventures leading a €12 million Series A round in Klearly, a Dutch payments startup.

-

How Rain’s $250M Series C Signals a New Phase for Stablecoin Payments

January 12, 2026Rain, a fintech building enterprise-grade stablecoin payments infrastructure, recently closed a $250 million Series C round. Led by ICONIQ Capital, the round values the company.

-

Apple Card’s New Chapter with Chase

January 9, 2026Apple has confirmed that Chase will become the new issuer of Apple Card, replacing Goldman Sachs over a transition period of roughly 24 months. The.

-

How PayPal and Microsoft Are Bringing Checkout Into AI Conversations

January 9, 2026AI has been moving closer to commerce for a while, mostly through discovery and recommendations. With the launch of Copilot Checkout, another boundary shifts. In.

-

Fiserv and Mastercard Expand Partnership Around Agentic Commerce

January 8, 2026In December 2025, Fiserv and Mastercard announced an expanded partnership focused on enabling what they describe as trusted agentic commerce for merchants. The collaboration builds.

-

Bunq Reapplies for a US Banking Licence

January 7, 2026Bunq, the Dutch challenger bank, has submitted a new application for a national US banking licence with the Office of the Comptroller of the Currency..

-

Flutterwave acquires Mono to strengthen open banking capabilities across African markets

January 6, 2026Flutterwave has agreed to acquire open banking company Mono, bringing financial data connectivity and account to account capabilities into its broader payments platform. The acquisition.

-

Airwallex’s Netherlands Investment Signals a Confident European Expansion Strategy

January 6, 2026Reuters reported that Tencent backed fintech company Airwallex plans to invest about €200 million in the Netherlands over the next five years, strengthening its presence.

-

Sumary Raises €4.2M Pre-Seed to Build AI-Native Finance Workflow Platform

January 5, 2026Copenhagen-based fintech startup Sumary has raised €4.2 million in a pre-seed funding round to continue developing its AI-driven finance workflow engine. The round was led.

-

PrimaryBid trims workforce and repositions its business model

December 31, 2025PrimaryBid has reduced its workforce by roughly 40 percent after reporting continued losses and facing a significant writedown from one of its major shareholders. The.

-

Mercury’s Bank Charter Move: What Filing With the OCC Really Signals

December 23, 2025Mercury has formally applied for a U.S. national bank charter. In December 2025, the company submitted an application to the Office of the Comptroller of.

-

Imprint’s path to a $1bn valuation

December 19, 2025Imprint reached unicorn status after closing a $150 million Series D funding round that valued the company at approximately $1.25 billion. The milestone mattered less.

-

PayPal’s push to bring small business banking in-house in the US

December 17, 2025PayPal has applied to establish a US industrial bank focused on small business lending. The application was submitted to the Utah Department of Financial Institutions.

-

Revolut wants to be your next mobile operator

December 17, 2025Revolut has been expanding its scope for years. What began as a payments app now covers accounts, cards, investing, crypto, insurance, and travel utilities. The.

-

Revolut adds XYO and pulls DePIN into mainstream fintech

December 11, 2025Revolut has added support for the XYO token, and it is a small but interesting signal for the industry. XYO is one of the earliest.

-

Airwallex buys into Indonesia: what this APAC move really signals

December 10, 2025Airwallex has taken a significant step in Asia-Pacific by acquiring a majority stake in PT Skye Sab Indonesia, a payments provider holding a PJP Category.

-

Innovatrics Backs Dalinora to Bring Trusted AI Financial Guidance to a Wider Audience

December 10, 2025Innovatrics has expanded its venture activity with a new investment in Dalinora, a Slovak platform that blends licensed financial expertise with artificial intelligence. The aim.

-

Airwallex reaches an 8 billion valuation after its 330 million Series G

December 8, 2025Airwallex has raised 330 million in new capital and reached an 8 billion valuation. It is a strong signal in a market where funding rounds.

-

Why Stripe is the next home for Metronome

December 4, 2025Metronome has shared that it signed a definitive agreement to be acquired by Stripe. The announcement is written with a steady tone. There is no.

-

Stablecoins, Payments and BNPL: The Key Regulatory Shifts This Month in the UK

December 3, 2025Regulators in the UK and EU have been busy shaping new expectations for the fintech and payments sector. The focus this month is on stablecoins,.

-

Wealthfront’s IPO: What the 2025 Move Means for Fintech

December 3, 2025Wealthfront has filed to go public in the United States. The company plans to sell 34.6 million shares at a price between 12 and 14.

-

Zepz rolls out stablecoin linked Visa cards

December 3, 2025Zepz, the company behind Sendwave and WorldRemit, has introduced a new Visa card that allows users to spend directly from stablecoin balances. The feature is.

-

European banks move toward a euro stablecoin

December 3, 2025A group of ten European banks has created a new company in Amsterdam that intends to issue a euro stablecoin. The group includes ING and.

-

How POM’s acquisition of FarPay signals a new phase for European invoicing fintech

November 28, 2025The news comes from the portal EU-Startups, which reported that Dutch fintech POM has acquired Danish invoicing automation company FarPay. The story frames the deal.

-

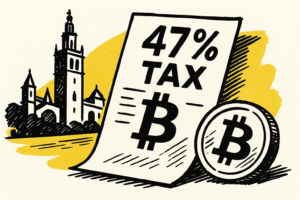

A 47% Crypto Tax Is Now on the Table in Spain

November 28, 2025Spain is reviewing a proposal that would raise the tax rate on personal cryptocurrency gains to as high as 47 percent. The plan was introduced.

-

Visa and Aquanow Bring Stablecoin Settlement Into the Mainstream

November 27, 2025Visa expanded its stablecoin settlement program by partnering with Aquanow, a Canadian digital asset infrastructure provider. The announcement confirms that Visa is now enabling select.

-

Klarna Introduces KlarnaUSD And Signals A New Phase For Stablecoins

November 27, 2025Klarna has always experimented with payment convenience, so its move into stablecoins was not exactly shocking. Still, the announcement of KlarnaUSD and the headline number.

-

Kraken raises USD 800 million to advance its strategic roadmap

November 24, 2025Kraken, a major digital asset exchange, announced that it has raised USD 800 million across two tranches to accelerate its push into regulated, multi-asset financial.

-

Saudi Arabia Sets a Confident Direction for Fintech

November 24, 2025Saudi Arabia is shaping a fintech landscape that grows quickly yet still feels coordinated. SAMA Governor Ayman Al Sayari recently outlined how the Kingdom plans.

-

7 Banking and Fintech Trends in 2026, According to Bernard Marr

November 24, 2025Bernard Marr, a well known futurist and bestselling author with over twenty books, recently published his take on the seven biggest banking and fintech trends.

-

Why ING Bank Śląski’s €93M Takeover of Goldman Sachs TFI Matters for Fintech Startups

November 21, 2025ING Bank Śląski has agreed to acquire the remaining 55% of Goldman Sachs TFI for about €93 million, taking full control of one of Poland’s.

-

Pipe’s reported 50% staff cut: a fintech “grow fast” case study in reverse

November 21, 2025When a once-$2 billion fintech trims roughly half its team, founders pay attention. US-based Pipe, an embedded capital and financial tools provider for SMBs, has.

-

Fast-Growing Danish Payments Startup Flatpay Hits Unicorn Status

November 19, 2025Here’s a growth story that feels almost unreal at first glance. Flatpay, a Danish payments startup serving small merchants across Europe, has reached a valuation.

-

Synchronised FX settlement opens new infrastructure paths

November 18, 2025The Bank of England (BoE), Monetary Authority of Singapore (MAS) and Bank of Thailand (BoT) have announced a joint initiative to explore synchronised cross-border foreign-exchange.

-

Nift expands into the UK with Clearpay

November 18, 2025Nift confirmed its UK expansion through a partnership with Clearpay, the UK arm of Afterpay. The idea is simple. When Clearpay shoppers make on-time repayments,.

-

BaFin’s €45m fine on JPMorgan SE: what fintech startups should learn

November 14, 2025Germany’s financial regulator BaFin issued a 45 million euro penalty to JPMorgan SE for failures in its anti money laundering processes. The case might look.

-

PPRO’s Buy Now Pay Local Solution and What It Means for Fintech Startups

November 13, 2025PPRO has introduced a solution called Buy Now Pay Local that lets merchants and payment service providers access multiple locally preferred buy now pay later.

-

Singapore’s SMEs Are Quietly Going Global, Says PayPal

November 12, 2025Cross-border commerce is no longer reserved for large corporations. According to an article shared by Fintechnews.sg, one in four Singapore businesses now sells abroad through.

-

Flowpay Expands to the Netherlands with €30M to Back Europe’s Small Businesses

November 12, 2025EU-Startups.com recently reported that Czech fintech Flowpay has launched in the Netherlands, supported by a €30 million facility from Fasanara Capital. It is a major.

-

UK Government Asks Financial Services Sector to Define Future AI Skills Requirements

November 6, 2025The UK government has asked the Financial Services Skills Commission (FSSC) to outline which AI and technology capabilities the financial services workforce will need over.

-

Lloyds prepares to roll out an AI financial assistant

November 6, 2025Lloyds Banking Group has announced that it will introduce an AI powered financial assistant into its mobile banking apps from 2026. The assistant will allow.

-

Worldline and Fipto Team Up to Advance Stablecoin Solutions in Europe

November 4, 2025Worldline has announced a collaboration with Fipto to test and deploy stablecoin use cases across Europe and parts of Asia-Pacific. The partnership focuses on bridging.

-

Every fintech founder should read this: the UK’s AI-in-finance reality check

November 4, 2025The 2025 Lloyds Banking Group Consumer Digital Index is packed with insight on how people across the UK are using artificial intelligence to manage their.

-

From trust gap to take off: How Vigilant AI.ai raised £585k to enable AI in regulated firms

November 4, 2025On 4 November 2025, the Derby-based startup Vigilant AI.ai announced a £585k pre-seed funding round led by Haatch, together with the East Midlands Combined County.

-

PayNearMe Is Using AI to Simplify Bill Payments

October 30, 2025PayNearMe’s new AI-powered Intelligent Virtual Agent (IVA) may sound like just another chatbot, but it’s a major step toward making bill payments easier and more.

-

Smarter Together: Humans and AI Powering the Future of Fintech

October 30, 2025In 2025, fintech companies across the world are proving that the best automation strategies still rely on people. The winning model isn’t full automation. It’s.

-

How Fintech Unicorns Are Using AI to Redefine Money

October 30, 2025AI has moved from the back office to the front stage of fintech. It is now part of how people pay, borrow, invest, and even.

-

Don’t Force Another App: What Husk Teaches About User-Centric Fintech

October 29, 2025Most users are tired of installing new apps. For fintech founders, this is a reminder that simplicity often wins. Users Don’t Want “One More App”..

-

Mastercard and PayPal set the stage for AI-driven commerce

October 29, 2025When two global payments leaders team up, it usually means a shift in how money moves. Mastercard and PayPal are now expanding their partnership to.

-

Shift4’s Big Bets: What’s Behind the Move to Acquire Worldline’s North American Arm

October 24, 2025The payments industry hasn’t taken a breath this year. And now, Shift4 Payments, Inc. is entering exclusive talks to acquire Worldline’s North American subsidiaries, a.

-

Ant International Grabs #4 Spot on Top 100 FinTech Companies List

October 24, 2025Ant International has officially entered fintech’s global top tier. The Singapore-based company secured the #4 position in FinTech Magazine’s 2025 Top 100 FinTech Companies list:.

-

Bringing £1.3 billion of mortgage debt to the blockchain: a fintech milestone

October 17, 2025mQube, through its digital lending platform MPowered Mortgages, has taken a major step by tokenising £1.3 billion of mortgage debt on a blockchain — the.

-

Mastercard’s first European Cyber Defense Exercise: What fintech founders can learn

October 17, 2025Mastercard hosted the first European edition of its multi-sector Cyber Defense Exercise (CDX) at its European Cyber Resilience Centre in Waterloo, Belgium. The hands-on event.

-

Revolut’s India push: entering a tough but high-potential payments market

October 13, 2025Revolut has launched its payments platform in India, a bold step into one of the world’s most competitive fintech markets. The rollout begins with 350,000.

-

MiCAR Meets the Digital Euro: A New Era for European Fintech Begins

October 13, 2025The EU’s Markets in Crypto-Assets Regulation (MiCAR) is moving into its most demanding phase, with new Regulatory Technical Standards (RTS) for stablecoins coming into effect.

-

When Big Banks Try Fintech: The Story of HSBC’s Zing

October 13, 2025In January 2024, HSBC launched Zing, a standalone international money-transfer app intended to compete with fintechs such as Wise and Remitly. The app let users.

-

Why BNPL Works and What That Means for Your Fintech

October 6, 2025Buy Now, Pay Later (BNPL) has become one of the most transformative forces in digital payments. Earlier this year, The Future of Global Payments &.

-

Fintech lessons from the Charlie Javice / JPMorgan case

October 3, 2025Fintech founder Charlie Javice has been sentenced to about seven years in prison for defrauding JPMorgan. Her startup, Frank – a platform meant to simplify.

-

Acquiring a U.S. Bank: The Fast-Track Strategy for UK Fintech Expansion

October 3, 2025For years, the U.S. has been the promised land for UK fintechs. The market is massive, but the regulatory gates are slow to open. Revolut.

-

Is Klarna Really 10 Years Behind Revolut?

October 1, 2025Business Insider recently reported a blunt warning from Klarna’s chairman: at a post-IPO celebration in Stockholm he reminded the crowd that “we are 10 years.

-

Brex Launches Stablecoin Payments Feature

October 1, 2025Brex has announced a new stablecoin payment feature for its business accounts. According to the company’s September 30, 2025 press release, Brex will be “the.

-

Remember When Visa Almost Bought Plaid? Here’s What Fintechs Can Learn From What Happened Next

September 19, 2025Remember early 2020? Visa announced it was acquiring Plaid for $5.3 billion. Everyone called it a win: for open banking, for fintech, for Plaid’s investors..

-

UK Stablecoin Caps: Risk Control or Innovation Killer?

September 18, 2025The Bank of England wants to put a leash on stablecoins. In its recent proposal, it suggested limiting how much individuals and businesses can hold.

-

RiskConcile acquires UK’s Fitz Partners as part of European expansion strategy

September 18, 2025Belgium-based regulatory technology firm RiskConcile has acquired London-headquartered Fitz Partners, a specialist provider of fund fees and expense data, in a move to expand its.

-

Seapoint Raises $3M to Build a Unified Financial Platform for European Startups

September 18, 2025Startup founders across Europe are still running into the same financial roadblocks: slow account approvals, fragmented tools, and hours lost to manual admin. Dublin-based fintech.

-

Claude’s New File Creation Powers: A Glimpse Into Fintech’s Future?

September 16, 2025Anthropic’s latest update to its AI assistant, Claude, allows users to generate and edit Excel files, Word documents, PowerPoint decks, and PDFs directly from chat..

-

Revolut Adds ‘Pay by Bank’ to Payments Gateway: A New Milestone in Open Banking

September 16, 2025Global fintech company Revolut (with over 60 million customers) has introduced a “Pay by Bank” option in its online payment gateway as of 10 September.

-

How Fyxer AI Turned a Boring Problem Into $30M, and What Fintech Founders Can Learn

September 10, 2025Most professionals aren’t drowning in strategy. They’re drowning in emails, meetings, and notes that go nowhere. London-based Fyxer AI spotted that, built a product to.

-

Revolut’s UAE License Approval: Lessons in Expansion for Fintech Founders

September 10, 2025Revolut’s recent success in securing in-principle approval for key payment licenses in the United Arab Emirates (UAE) offers a masterclass in fintech expansion. The London-based.

-

Stripe’s $92B Crypto Bet: Inside the “Tempo” Blockchain

September 5, 2025Stripe, the $92 billion payments giant, has officially unveiled Tempo, a payments-focused Layer 1 blockchain developed with crypto venture firm Paradigm. Unlike most blockchains born.

-

Brex secures EU Payment Institution License via Netherlands. A new chapter in global expansion

September 5, 2025Brex, the San Francisco-based fintech unicorn known for corporate cards and spend management, has secured a Payment Institution (PI) license in the European Union via.

-

Klarna’s Long-Awaited IPO: Lessons for Startup Founders from a BNPL Giant’s Journey

September 3, 2025Klarna Group plc, the Stockholm-founded buy now, pay later (BNPL) fintech, has officially kicked off its initial public offering after a prolonged wait. On September.

-

Klarna x Walmart Canada: What Fintechs Can Learn from This Massive BNPL Rollout

September 1, 2025It’s official: Walmart Canada is now Klarna’s largest omnichannel retail partner in the country. With over 400 stores going live, customers can now use Buy.

-

Chift: Building Europe’s Financial Connectivity Layer

August 26, 2025Europe’s financial software stack is highly fragmented. In the U.S., a startup might integrate with QuickBooks and Xero and be ready for launch. In Europe,.

-

Monzo’s MVNO Move: What Fintechs Can Learn About Diversification

August 18, 2025Monzo is stepping outside of banking and into mobile. The UK challenger bank announced plans to launch an MVNO (mobile virtual network operator), offering customers.

-

What Revolut’s Auditor Switch Teaches Fintech Founders About Scaling Into Regulated Markets

August 11, 2025Revolut – widely recognized as the UK’s top fintech unicorn – has appointed Ernst & Young (EY) as its new global auditor, replacing its long-term.

-

Why Fintechs Can’t Ignore Osborne’s Call on Crypto and Stablecoins

August 5, 2025Former UK Chancellor George Osborne, now an advisor to Coinbase, recently said for the Financial Times that the UK has already missed its first chance.

-

What Fintech Startups Can Learn from Airwallex UK’s 109% Growth

August 5, 2025Another fintech darling just smashed triple-digit growth, but what’s actually under the hood? Airwallex UK reported a 109% YoY revenue increase for the first half.

-

Inside Ramp’s $500M Raise: Strategic Lessons from a $22.5B Fintech Valuation

August 4, 2025Ramp, the NYC-based spend management fintech, has pulled off a rare feat in a sluggish funding market: two major raises in 45 days. After raising.

-

Revolut’s Rumored U.S. Bank Buy: Shortcut to Expansion or Risky Bet?

July 31, 2025British fintech powerhouse Revolut is reportedly considering a shortcut to crack the American market; buying a U.S. bank outright. The idea? Acquire a small, federally.

-

Mastercard Just Scaled a B2B Painkiller – Here’s Why Fintech Should Care

July 30, 2025If you’ve ever worked on the supplier side of B2B payments, you know the pain: virtual cards promise fast payments, but processing them is tedious..

-

Going Global Without Giving Up Control: Playbook from Wise

July 29, 2025Wise just made a bold move. The UK fintech announced it’s shifting its primary listing to the U.S., while also extending its dual-class share structure.

-

Monzo’s £21M Fine: A Lesson in Compliance for Fintech Startups

July 28, 2025When one of the UK’s best-known digital banks gets fined £21 million, the fintech world pays attention. That’s exactly what happened to Monzo after regulators.

-

When Your Data Isn’t Really Yours: What JPMorgan’s Move Means for Fintechs

July 28, 2025Jamie Dimon just reminded fintechs who’s in charge of the pipes. JPMorgan Chase is preparing to charge fintech firms like Plaid and Intuit for access.

-

Brazil’s Pix System Is Booming. What Europe Can Learn?

July 1, 2025Brazil’s Pix has quietly become one of the most successful fintech stories on the planet. And no, it’s not a startup. It’s a public instant.

-

Why Sweden Barely Uses Cash.. and What That Means for the Rest of Us

July 1, 2025How Sweden quietly became a real-time payments pioneer. Sweden didn’t hold a flashy press conference announcing the death of cash. It just kind of… stopped.

-

What If You Never Raised a Dime? Fintechs Built Without VC

June 27, 2025For all the pitch decks, demo days, and “warm intros”, it’s easy to forget one thing: You don’t have to raise venture capital to build.

-

KPIs That Actually Matter for Fintech Startups in 2025

June 27, 2025Fintech founders: the right metrics can make or break you. In 2025, growth and retention aren’t just buzzwords – they’re survival. Track what matters and.

-

Unicorns Are Rarer in 2025. Should You Even Want to Be One?

June 27, 2025Fintech startup founders will remember the glory days of 2021 when unicorn fever was at its height. Back then, sky-high valuations and cheap capital created.

-

Fintech Gets Strategic Backing in the UK Government’s 10-Year Plan for Growth

June 26, 2025The Industrial Strategy is a 10-year government plan to boost investment and grow future industries in the UK. It promises to make it easier and.

-

Building Trust in Web3? MoonPay Has a New Playbook

June 25, 2025Web3 feels like a wild west of projects and protocols. Newcomers and veterans alike often struggle to figure out which decentralized apps (dApps) or platforms.

-

GENIUS Act passed: a big win for stablecoins. But what now?

June 18, 2025The U.S. Senate has passed the bipartisan GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) by a 68–30 vote. This landmark bill creates.

-

Inside Visa Flex: One card, real-time choices, and a new way to pay

June 18, 2025There’s been a major shift happening in payments; and it’s not another crypto thing. Instead, it’s something deceptively simple: letting people choose how they want.

-

Banking Apps Are Too Passive. Revolut’s AI Wants to Fix That

June 18, 2025If you thought AI in banking was all hype and no substance, Revolut wants to change your mind — starting with an in-app assistant that.

-

Are Amazon and Walmart About to Launch Their Own Stablecoins?

June 17, 2025They’re not printing money (yet). But they’re inching toward a future where they might not need banks — or even Visa. Multiple reports now suggest.

-

Ramp’s Playbook: Scale Fast, Burn Slow, Raise Big

June 17, 2025Ramp is reportedly raising around $200 million at a $16 billion valuation — just three months after a $13B secondary sale. For those keeping score,.

-

Launched in 2024. Gaining Ground Fast. Here Are 5 Fintech Startups Doing It Right

June 17, 20252024 gave us a fresh wave of fintechs that didn’t bother waiting in line. They launched, made noise, and started landing deals before most people.

-

Aspora Scores $53M to Redesign Banking for Global Citizens

June 16, 2025Aspora’s founding team is building cross-border banking tools. The London-based startup just closed a $53 million Series B led by Sequoia and Greylock, with Revolut cofounder.

-

No Pockets? No Problem: The Past, Present, and Future of Palm-Based Payments

June 12, 2025Paying with your hand isn’t science fiction. It’s showing up in stores, stadiums, and train stations around the world. The concept of using your hand.

-

Tebi’s €30M Series B: From Side-Project POS to a Hospitality Fintech OS

June 11, 2025Tebi, an Amsterdam-based fintech startup focused on hospitality businesses, announced a €30 million Series B funding in June 2025 led by Alphabet’s growth fund CapitalG,.

-

Supercharged by Nvidia: Why the FCA’s New AI Sandbox Is a Big Deal for Fintech

June 10, 2025Sometimes regulators get it right. This week, the UK’s Financial Conduct Authority (FCA) quietly did something big. It teamed up with Nvidia to launch a.

-

From Crypto Startup to Wall Street: What Circle’s IPO Teaches Fintech Founders

June 6, 2025In a June 4 press release, Circle Internet Group, Inc. (the fintech behind USDC stablecoin) announced the upsizing of its IPO to 34 million shares.

-

Pricing Made Them, or Broke Them: 10 Real Fintech Stories

June 6, 2025Pricing can make or break a fintech startup. Charge too much or too little, and you might scare off customers or bleed cash. Get it.

-

Fintech’s 3% Market Share Is Growing 3x Faster Than the Entire Industry

June 5, 2025Global fintech is no longer just the bold upstart nipping at the heels of legacy finance. It’s emerging as a disciplined, fast-scaling force with real.

-

Revolut launches its first ATMs. And yes, it’s a big deal

June 4, 2025It finally happened. The world’s biggest branchless bank just did something very… physical. Revolut has launched its first-ever branded ATMs, starting with 50 machines across.

-

€1M Later, Husk Shows Us How to Actually Build a Fintech for Startups

June 2, 2025Imagine you're running a startup. You've just hired a couple of new developers, your marketing budget just tripled overnight, and your cloud bill looks like.

-

Adyen Expands iPhone Checkout to 7 More European Countries

May 29, 2025Adyen just made it even easier to accept in person payments. No terminals. No extra devices. No cables. Just an iPhone. As of May 27,.

-

Could Crédit Coopératif Be Anytime’s Next Home? Talks Are on the Table

May 26, 2025Crédit Coopératif and Orange Bank are officially "seeing each other." At least on paper. The two have entered exclusive talks about a potential deal that.

-

Top 5 Fintechs That Went From “No Thanks” to “Next Big Thing”

May 26, 2025If you’re building a fintech startup, chances are you’ve heard some polite version of “Not sure there’s a market for this” or “Sounds risky.” Most.

-

Monarch Just Turned the Fintech Freeze Into a $75M Warm-Up

May 26, 2025Monarch has raised $75 million in Series B funding, one of the largest consumer fintech rounds in the U.S. this year so far. The company.

-

Startup Affiniti Thinks Your Next CFO Might Be a Bot

May 25, 2025Most fintech tools weren’t built for your local auto shop. Affiniti is changing that. Founded in 2021 by Aaron Bai and Sahil Phadnis while they.

-

Story of Chime: Not a Bank, But Better (Except When It Wasn’t)

May 25, 2025Chime launched in 2012 with a simple premise: what if people actually liked their bank? Founded by Chris Britt and Ryan King, Chime offered a.

-

New UK rules ahead for Klarna and BNPL players

May 25, 2025Big changes are coming for Buy-Now, Pay-Later (BNPL) in the UK. Earlier this month, HM Treasury announced that the days of BNPL operating like the.

-

Airwallex Raises $300M at $6.2B Valuation: How a Cross-Border Fintech Took Off

May 24, 2025Singapore-based Airwallex just raised a fresh $300 million in Series F funding, bringing its total capital to over $1.2 billion and boosting its valuation to.

-

Wero and Revolut? No Statement Yet. But the Pieces Fit.

May 24, 2025A fresh round of buzz is making its way through the European payments world; and it’s not just about another product launch. According to exclusive.

-

Story of Wise: Wanted Fair Rates. Oops, Built a Fintech Empire.

May 22, 2025Wise (formerly TransferWise) is one of those rare fintechs that didn’t just chase hype but built something genuinely useful. Founded in 2011 by two Estonian.

-

Visa’s New Program Could Save Fintechs Months of Setup

May 22, 2025Visa has launched a new program to make life easier for financial institutions and fintechs looking to work more closely together. Announced on May 21,.

-

U.S. Stablecoin Bill Advances: What Fintech Founders Need to Know

May 21, 2025The United States is making a move toward serious digital asset rules with the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins). While.

-

Google’s AI Checkout Shows What Frictionless Really Means

May 21, 2025At Google I/O 2025, the company announced a major upgrade to online shopping: a new AI-driven feature called agentic checkout, part of its broader AI.

-

What Fintechs Can Learn from Ontik, the ‘Stripe for Trade Credit’

May 20, 2025London-based fintech Ontik (founded in 2023) is tackling one of the last manual corners of the economy – trade credit for wholesale merchants. Co‑founders Chris.

-

BBVA and CaixaBank Launch Europe’s First Interbank RTP Transactions: What It Means for Fintech

May 20, 2025Spanish banks BBVA and CaixaBank have completed Europe’s first interbank Request-to-Pay (RTP) transactions. In a live pilot during April and May 2025, the two banks.

-

Revolut Announces €1 Billion France Expansion and Banking Licence Bid

May 19, 2025British fintech Revolut announced at President Macron’s Choose France investment summit that it will invest €1 billion in France over three years and apply for.

-

AI Agents in Payments: Mastercard’s Agent Pay vs Visa’s Intelligent Commerce

May 18, 2025In May 2025, both Mastercard and Visa unveiled AI-driven shopping assistants, marking a new era of “agentic commerce.” Each network’s solution lets digital assistants research,.

-

What Fintechs Need to Know About Mastercard and MoonPay’s Stablecoin Push

May 16, 2025Mastercard and crypto-fintech MoonPay have announced a global partnership to make stablecoin spending as easy as using cash or cards. Under the deal, fintech companies.

-

Klarna’s AI-Driven Restructuring: Lessons for Fintechs

May 15, 2025Klarna, the Swedish fintech giant known for buy-now-pay-later services, recently cut its workforce by about 40%—from 5,500 to roughly 3,400 employees. Much of this was.

-

10 Metrics Every Fintech CEO Should Track Weekly

May 15, 2025Running a fintech company means making fast decisions with limited visibility. That’s why tracking the right metrics each week matters more than ever. These ten.

-

Europe’s Newest Fintech Unicorns: What They Did Right and What You Can Learn

May 14, 2025Europe’s fintech scene shows that sharp execution and customer focus can still win, even in tough markets. The newest unicorns didn’t chase hype; they solved.

-

Klarna Hits Pause on IPO: What Fintech Founders Can Learn from a Strategic Slowdown

May 14, 2025Klarna, the Swedish fintech giant renowned for pioneering the Buy Now, Pay Later (BNPL) model, has recently paused its much-anticipated U.S. IPO plans. The decision,.

-

Scaling Trust: What TrueLayer’s $10B Month Teaches About Infrastructure at Speed

May 13, 2025TrueLayer, a leading open-banking payments network, announced in May 2025 that it processed over $10 billion in payment volume during April – exceeding $100 billion on an.

-

What Navro’s €36M Raise Tells Us About Winning in Fintech Today

May 13, 2025In a year when UK fintech funding fell by 27%, Navro’s €36 million Series B raise stands out; not just for the number, but for.

-

Dubai FinTech Summit 2025: A Global Powerhouse for Startups and Innovation

May 12, 2025The Dubai FinTech Summit 2025, hosted by the Dubai International Financial Centre (DIFC) on May 12–13 2025, is shaping up to be the year’s premier.

-

Payoneer’s Crossroads: What Fintech Startups Can Learn from a Scaling Giant Under Pressure

May 12, 2025Payoneer Global Inc., the fintech company known for its cross-border payments services, is exploring a potential sale, according to Fortune.com. The company has brought on.

-

Revolut’s Rise: How a Fintech Startup Redefined Global Banking in Just 10 Years

May 2, 2025In less than a decade, Revolut has grown from a modest London-based fintech startup into one of the world’s largest and most innovative digital financial.

-

6 AI Agents That Are Transforming How Fintech Does Investment Research

May 1, 2025A new wave of AI-powered tools is starting to reshape investment research in fintech. As Forbes recently reported in an article by Jeff Kauflin, companies.

-

All-in-one payment cards examples: Visa Flexible Credential, Mastercard One Credential, and Curve

April 28, 2025As consumer payment behaviour evolves toward personalization, convenience, and control, major networks and fintechs are reshaping the way people pay. Visa’s Flexible Credential, Mastercard’s One.

-

Who’s Who in the EBAday 2025 Fintech Zone? Meet the 16 Startups to Watch

April 23, 2025As the financial services industry continues to evolve, EBAday 2025 provides a timely window into the ideas and innovations driving that change. This year’s Fintech.

-

Why Fintech Founders Need Coaching, Not Just Capital

April 14, 2025In fintech, capital is often seen as the cure-all. You raise a round, extend your runway, hire a few smart people, and the story should.

-

Embedded finance in 2025: Every company is becoming a Fintech

April 6, 2025Embedded finance is now a major economic force, projected to drive over $7 trillion in global transaction volume by 2030. In 2025 alone, it’s powering.

-

19 Expert Strategies for Fintech Startups to Stand Out in a Crowded Market

March 31, 2025With fintech competition at its peak, standing out takes more than great design or pricing. True differentiation comes from solving real problems, building trust, and.

-

AI, Growth, and Trust: Signals from Global CEOs for Fintech

February 10, 2026PwC’s 29th Global CEO Survey brings together perspectives from 4,454 CEOs across 95 countries and territories, spanning a broad range of industries and company sizes..

-

Duna Series A funding and what it means for business identity

February 5, 2026Duna has raised a 30 million euro Series A led by CapitalG, the growth investment arm connected to Alphabet. This brings its total funding past.

-

Corpay Agrees to Sell PayByPhone as It Refines Its Focus

February 5, 2026Corpay announced an agreement to sell PayByPhone, its mobile parking payments business, as part of a move to concentrate more tightly on its core corporate.

-

EnFi raises $15M and banks are paying attention to AI in credit teams

February 5, 2026EnFi, a Boston-based company building AI agents for commercial lending, has raised $15 million in Series A funding. The round includes investors connected to more.

-

Klarna backs Google’s Universal Commerce Protocol

February 4, 2026Klarna announced it is backing Google’s Universal Commerce Protocol, known as UCP. The goal of UCP is to create a shared way for AI agents,.

-

Airwallex Begins Official Launch in Germany

February 4, 2026Airwallex, the global financial platform originally founded in Melbourne in 2015 and now based in Singapore, has launched operations in Germany as of early February.

-

Tapi’s $27 M Series B and What It Means for Payments in Latin America

February 4, 2026Tapi, a Latin American paytech founded in 2022, announced a $27 million Series B round led by Kaszek, with participation from Endeavor Catalyst and Latitud..

-

Incard raises £10M to build a financial operating system for digital businesses

February 2, 2026London-based fintech Incard has raised £10 million in a Series A round led by Smartfin, with participation from Founders Capital, MountFund, and angel investors. The.

-

Talos Extends Series B to $150 Million with Strategic Investors

February 2, 2026Talos, the New York based institutional digital asset infrastructure provider, announced a $45 million extension to its Series B round. This brings the total Series.

-

Memcyco: $37M bet on stopping fraud before it happens

February 2, 2026Memcyco, an Israeli cybersecurity company founded in 2021, has raised $37 million in a Series A funding round to expand its pre-emptive fraud defence platform..

-

Rogo raises $75M to scale AI inside investment banking

January 30, 2026Rogo has raised a $75 million Series C round, bringing total funding to more than $165 million. Alongside the raise, the company announced the opening.

-

Mastercard Agent Suite: Turning Agentic AI Readiness Into Reality

January 28, 2026Earlier this week, Mastercard announced Mastercard Agent Suite, a new offering designed to help enterprises prepare for and deploy agentic artificial intelligence. The focus is.

-

Revolut Opens Full Banking Operations in Mexico

January 27, 2026Revolut has launched full banking operations in Mexico, becoming the first market outside Europe where the company operates as a fully licensed bank. The new.

-

How Jelou Is Scaling Conversational AI for Transactions After a $10M Series A

January 27, 2026Jelou, a company building transactional AI inside messaging apps, announced a $10 million Series A round to accelerate product development and international expansion. The round.

-

PayPal Bets on Agentic Commerce with Cymbio Acquisition

January 26, 2026Earlier this month, PayPal announced it would acquire Cymbio, a commerce orchestration platform that helps brands sell across emerging AI-driven channels. The deal is more.

-

Pomelo’s $55 Million Series C and What It Signals for Fintech in LatAm

January 23, 2026Pomelo, an Argentine fintech focused on payments infrastructure, just closed a $55 million Series C round led by Kaszek and Insight Partners, with support from.

-

Cloover’s €1.04 Billion Financing Commitment and What It Signals for Climate Fintech

January 22, 2026Berlin-based climate fintech Cloover has secured a €1.04 billion financing commitment, combining €18.8 million in Series A equity with a €1.02 billion debt facility. The.

-

AI in UK Financial Services: Progress Without a Safety Net

January 20, 2026In January 2026, the UK Treasury Committee published a detailed report on the use of artificial intelligence in financial services. Its conclusion is blunt: AI.

-

Polygon Labs Expands into Licensed Stablecoin Payments with Strategic Acquisitions

January 20, 2026Polygon Labs announced in January 2026 that it has agreed to acquire two U.S. crypto firms, Coinme and Sequence, for more than $250 million in.

-

Revolut’s Expansion into Peru: What’s Happening Now

January 20, 2026On 19 January 2026, Revolut announced that it has applied for a full banking licence in Peru. The company also confirmed the appointment of Julien.

-

WeLab’s $220M Series D: A Strategic Capital Boost for Pan-Asian Fintech

January 19, 2026WeLab, a Hong Kong-based fintech platform, has closed a US $220 million Series D strategic financing. It is the company’s largest round to date and.

-

Alpaca’s $150m Series D and What It Signals for Fintech

January 15, 2026Alpaca has raised $150 million in a Series D round, valuing the company at $1.15 billion and pushing it into unicorn territory. The round was.

-

PayPal Backs Klearly’s €12 Million Series A

January 14, 2026European fintech funding opened the year with a notable signal: PayPal Ventures leading a €12 million Series A round in Klearly, a Dutch payments startup.

-

How Rain’s $250M Series C Signals a New Phase for Stablecoin Payments

January 12, 2026Rain, a fintech building enterprise-grade stablecoin payments infrastructure, recently closed a $250 million Series C round. Led by ICONIQ Capital, the round values the company.

-

Apple Card’s New Chapter with Chase

January 9, 2026Apple has confirmed that Chase will become the new issuer of Apple Card, replacing Goldman Sachs over a transition period of roughly 24 months. The.

-

How PayPal and Microsoft Are Bringing Checkout Into AI Conversations

January 9, 2026AI has been moving closer to commerce for a while, mostly through discovery and recommendations. With the launch of Copilot Checkout, another boundary shifts. In.

-

Fiserv and Mastercard Expand Partnership Around Agentic Commerce

January 8, 2026In December 2025, Fiserv and Mastercard announced an expanded partnership focused on enabling what they describe as trusted agentic commerce for merchants. The collaboration builds.

-

Bunq Reapplies for a US Banking Licence

January 7, 2026Bunq, the Dutch challenger bank, has submitted a new application for a national US banking licence with the Office of the Comptroller of the Currency..

-

Flutterwave acquires Mono to strengthen open banking capabilities across African markets

January 6, 2026Flutterwave has agreed to acquire open banking company Mono, bringing financial data connectivity and account to account capabilities into its broader payments platform. The acquisition.

-

Airwallex’s Netherlands Investment Signals a Confident European Expansion Strategy

January 6, 2026Reuters reported that Tencent backed fintech company Airwallex plans to invest about €200 million in the Netherlands over the next five years, strengthening its presence.

-

Sumary Raises €4.2M Pre-Seed to Build AI-Native Finance Workflow Platform

January 5, 2026Copenhagen-based fintech startup Sumary has raised €4.2 million in a pre-seed funding round to continue developing its AI-driven finance workflow engine. The round was led.

-

PrimaryBid trims workforce and repositions its business model

December 31, 2025PrimaryBid has reduced its workforce by roughly 40 percent after reporting continued losses and facing a significant writedown from one of its major shareholders. The.

-

Mercury’s Bank Charter Move: What Filing With the OCC Really Signals

December 23, 2025Mercury has formally applied for a U.S. national bank charter. In December 2025, the company submitted an application to the Office of the Comptroller of.

-

Imprint’s path to a $1bn valuation

December 19, 2025Imprint reached unicorn status after closing a $150 million Series D funding round that valued the company at approximately $1.25 billion. The milestone mattered less.

-

PayPal’s push to bring small business banking in-house in the US

December 17, 2025PayPal has applied to establish a US industrial bank focused on small business lending. The application was submitted to the Utah Department of Financial Institutions.

-

Revolut wants to be your next mobile operator

December 17, 2025Revolut has been expanding its scope for years. What began as a payments app now covers accounts, cards, investing, crypto, insurance, and travel utilities. The.

-

Revolut adds XYO and pulls DePIN into mainstream fintech

December 11, 2025Revolut has added support for the XYO token, and it is a small but interesting signal for the industry. XYO is one of the earliest.

-

Airwallex buys into Indonesia: what this APAC move really signals

December 10, 2025Airwallex has taken a significant step in Asia-Pacific by acquiring a majority stake in PT Skye Sab Indonesia, a payments provider holding a PJP Category.

-

Innovatrics Backs Dalinora to Bring Trusted AI Financial Guidance to a Wider Audience

December 10, 2025Innovatrics has expanded its venture activity with a new investment in Dalinora, a Slovak platform that blends licensed financial expertise with artificial intelligence. The aim.

-

Airwallex reaches an 8 billion valuation after its 330 million Series G

December 8, 2025Airwallex has raised 330 million in new capital and reached an 8 billion valuation. It is a strong signal in a market where funding rounds.

-

Why Stripe is the next home for Metronome

December 4, 2025Metronome has shared that it signed a definitive agreement to be acquired by Stripe. The announcement is written with a steady tone. There is no.

-

Stablecoins, Payments and BNPL: The Key Regulatory Shifts This Month in the UK

December 3, 2025Regulators in the UK and EU have been busy shaping new expectations for the fintech and payments sector. The focus this month is on stablecoins,.

-

Wealthfront’s IPO: What the 2025 Move Means for Fintech

December 3, 2025Wealthfront has filed to go public in the United States. The company plans to sell 34.6 million shares at a price between 12 and 14.

-

Zepz rolls out stablecoin linked Visa cards

December 3, 2025Zepz, the company behind Sendwave and WorldRemit, has introduced a new Visa card that allows users to spend directly from stablecoin balances. The feature is.

-

European banks move toward a euro stablecoin

December 3, 2025A group of ten European banks has created a new company in Amsterdam that intends to issue a euro stablecoin. The group includes ING and.

-

How POM’s acquisition of FarPay signals a new phase for European invoicing fintech

November 28, 2025The news comes from the portal EU-Startups, which reported that Dutch fintech POM has acquired Danish invoicing automation company FarPay. The story frames the deal.

-

A 47% Crypto Tax Is Now on the Table in Spain

November 28, 2025Spain is reviewing a proposal that would raise the tax rate on personal cryptocurrency gains to as high as 47 percent. The plan was introduced.

-

Visa and Aquanow Bring Stablecoin Settlement Into the Mainstream

November 27, 2025Visa expanded its stablecoin settlement program by partnering with Aquanow, a Canadian digital asset infrastructure provider. The announcement confirms that Visa is now enabling select.

-

Klarna Introduces KlarnaUSD And Signals A New Phase For Stablecoins

November 27, 2025Klarna has always experimented with payment convenience, so its move into stablecoins was not exactly shocking. Still, the announcement of KlarnaUSD and the headline number.

-

Kraken raises USD 800 million to advance its strategic roadmap

November 24, 2025Kraken, a major digital asset exchange, announced that it has raised USD 800 million across two tranches to accelerate its push into regulated, multi-asset financial.

-

Saudi Arabia Sets a Confident Direction for Fintech

November 24, 2025Saudi Arabia is shaping a fintech landscape that grows quickly yet still feels coordinated. SAMA Governor Ayman Al Sayari recently outlined how the Kingdom plans.

-

7 Banking and Fintech Trends in 2026, According to Bernard Marr

November 24, 2025Bernard Marr, a well known futurist and bestselling author with over twenty books, recently published his take on the seven biggest banking and fintech trends.

-

Why ING Bank Śląski’s €93M Takeover of Goldman Sachs TFI Matters for Fintech Startups

November 21, 2025ING Bank Śląski has agreed to acquire the remaining 55% of Goldman Sachs TFI for about €93 million, taking full control of one of Poland’s.

-

Pipe’s reported 50% staff cut: a fintech “grow fast” case study in reverse

November 21, 2025When a once-$2 billion fintech trims roughly half its team, founders pay attention. US-based Pipe, an embedded capital and financial tools provider for SMBs, has.

-

Fast-Growing Danish Payments Startup Flatpay Hits Unicorn Status

November 19, 2025Here’s a growth story that feels almost unreal at first glance. Flatpay, a Danish payments startup serving small merchants across Europe, has reached a valuation.

-

Synchronised FX settlement opens new infrastructure paths

November 18, 2025The Bank of England (BoE), Monetary Authority of Singapore (MAS) and Bank of Thailand (BoT) have announced a joint initiative to explore synchronised cross-border foreign-exchange.

-

Nift expands into the UK with Clearpay

November 18, 2025Nift confirmed its UK expansion through a partnership with Clearpay, the UK arm of Afterpay. The idea is simple. When Clearpay shoppers make on-time repayments,.

-

BaFin’s €45m fine on JPMorgan SE: what fintech startups should learn

November 14, 2025Germany’s financial regulator BaFin issued a 45 million euro penalty to JPMorgan SE for failures in its anti money laundering processes. The case might look.

-

PPRO’s Buy Now Pay Local Solution and What It Means for Fintech Startups

November 13, 2025PPRO has introduced a solution called Buy Now Pay Local that lets merchants and payment service providers access multiple locally preferred buy now pay later.

-

Singapore’s SMEs Are Quietly Going Global, Says PayPal

November 12, 2025Cross-border commerce is no longer reserved for large corporations. According to an article shared by Fintechnews.sg, one in four Singapore businesses now sells abroad through.

-

Flowpay Expands to the Netherlands with €30M to Back Europe’s Small Businesses

November 12, 2025EU-Startups.com recently reported that Czech fintech Flowpay has launched in the Netherlands, supported by a €30 million facility from Fasanara Capital. It is a major.

-

UK Government Asks Financial Services Sector to Define Future AI Skills Requirements

November 6, 2025The UK government has asked the Financial Services Skills Commission (FSSC) to outline which AI and technology capabilities the financial services workforce will need over.

-

Lloyds prepares to roll out an AI financial assistant

November 6, 2025Lloyds Banking Group has announced that it will introduce an AI powered financial assistant into its mobile banking apps from 2026. The assistant will allow.

-

Worldline and Fipto Team Up to Advance Stablecoin Solutions in Europe

November 4, 2025Worldline has announced a collaboration with Fipto to test and deploy stablecoin use cases across Europe and parts of Asia-Pacific. The partnership focuses on bridging.

-

Every fintech founder should read this: the UK’s AI-in-finance reality check

November 4, 2025The 2025 Lloyds Banking Group Consumer Digital Index is packed with insight on how people across the UK are using artificial intelligence to manage their.

-

From trust gap to take off: How Vigilant AI.ai raised £585k to enable AI in regulated firms

November 4, 2025On 4 November 2025, the Derby-based startup Vigilant AI.ai announced a £585k pre-seed funding round led by Haatch, together with the East Midlands Combined County.

-

PayNearMe Is Using AI to Simplify Bill Payments

October 30, 2025PayNearMe’s new AI-powered Intelligent Virtual Agent (IVA) may sound like just another chatbot, but it’s a major step toward making bill payments easier and more.

-

Smarter Together: Humans and AI Powering the Future of Fintech

October 30, 2025In 2025, fintech companies across the world are proving that the best automation strategies still rely on people. The winning model isn’t full automation. It’s.

-

How Fintech Unicorns Are Using AI to Redefine Money

October 30, 2025AI has moved from the back office to the front stage of fintech. It is now part of how people pay, borrow, invest, and even.

-

Don’t Force Another App: What Husk Teaches About User-Centric Fintech

October 29, 2025Most users are tired of installing new apps. For fintech founders, this is a reminder that simplicity often wins. Users Don’t Want “One More App”..

-

Mastercard and PayPal set the stage for AI-driven commerce

October 29, 2025When two global payments leaders team up, it usually means a shift in how money moves. Mastercard and PayPal are now expanding their partnership to.

-

Shift4’s Big Bets: What’s Behind the Move to Acquire Worldline’s North American Arm

October 24, 2025The payments industry hasn’t taken a breath this year. And now, Shift4 Payments, Inc. is entering exclusive talks to acquire Worldline’s North American subsidiaries, a.

-

Ant International Grabs #4 Spot on Top 100 FinTech Companies List

October 24, 2025Ant International has officially entered fintech’s global top tier. The Singapore-based company secured the #4 position in FinTech Magazine’s 2025 Top 100 FinTech Companies list:.

-

Bringing £1.3 billion of mortgage debt to the blockchain: a fintech milestone

October 17, 2025mQube, through its digital lending platform MPowered Mortgages, has taken a major step by tokenising £1.3 billion of mortgage debt on a blockchain — the.

-

Mastercard’s first European Cyber Defense Exercise: What fintech founders can learn

October 17, 2025Mastercard hosted the first European edition of its multi-sector Cyber Defense Exercise (CDX) at its European Cyber Resilience Centre in Waterloo, Belgium. The hands-on event.

-

Revolut’s India push: entering a tough but high-potential payments market

October 13, 2025Revolut has launched its payments platform in India, a bold step into one of the world’s most competitive fintech markets. The rollout begins with 350,000.

-

MiCAR Meets the Digital Euro: A New Era for European Fintech Begins

October 13, 2025The EU’s Markets in Crypto-Assets Regulation (MiCAR) is moving into its most demanding phase, with new Regulatory Technical Standards (RTS) for stablecoins coming into effect.

-

When Big Banks Try Fintech: The Story of HSBC’s Zing

October 13, 2025In January 2024, HSBC launched Zing, a standalone international money-transfer app intended to compete with fintechs such as Wise and Remitly. The app let users.

-

Why BNPL Works and What That Means for Your Fintech

October 6, 2025Buy Now, Pay Later (BNPL) has become one of the most transformative forces in digital payments. Earlier this year, The Future of Global Payments &.

-

Fintech lessons from the Charlie Javice / JPMorgan case

October 3, 2025Fintech founder Charlie Javice has been sentenced to about seven years in prison for defrauding JPMorgan. Her startup, Frank – a platform meant to simplify.

-

Acquiring a U.S. Bank: The Fast-Track Strategy for UK Fintech Expansion

October 3, 2025For years, the U.S. has been the promised land for UK fintechs. The market is massive, but the regulatory gates are slow to open. Revolut.

-

Is Klarna Really 10 Years Behind Revolut?

October 1, 2025Business Insider recently reported a blunt warning from Klarna’s chairman: at a post-IPO celebration in Stockholm he reminded the crowd that “we are 10 years.

-

Brex Launches Stablecoin Payments Feature

October 1, 2025Brex has announced a new stablecoin payment feature for its business accounts. According to the company’s September 30, 2025 press release, Brex will be “the.

-

Remember When Visa Almost Bought Plaid? Here’s What Fintechs Can Learn From What Happened Next

September 19, 2025Remember early 2020? Visa announced it was acquiring Plaid for $5.3 billion. Everyone called it a win: for open banking, for fintech, for Plaid’s investors..

-

UK Stablecoin Caps: Risk Control or Innovation Killer?

September 18, 2025The Bank of England wants to put a leash on stablecoins. In its recent proposal, it suggested limiting how much individuals and businesses can hold.

-

RiskConcile acquires UK’s Fitz Partners as part of European expansion strategy

September 18, 2025Belgium-based regulatory technology firm RiskConcile has acquired London-headquartered Fitz Partners, a specialist provider of fund fees and expense data, in a move to expand its.

-

Seapoint Raises $3M to Build a Unified Financial Platform for European Startups

September 18, 2025Startup founders across Europe are still running into the same financial roadblocks: slow account approvals, fragmented tools, and hours lost to manual admin. Dublin-based fintech.

-

Claude’s New File Creation Powers: A Glimpse Into Fintech’s Future?

September 16, 2025Anthropic’s latest update to its AI assistant, Claude, allows users to generate and edit Excel files, Word documents, PowerPoint decks, and PDFs directly from chat..

-

Revolut Adds ‘Pay by Bank’ to Payments Gateway: A New Milestone in Open Banking

September 16, 2025Global fintech company Revolut (with over 60 million customers) has introduced a “Pay by Bank” option in its online payment gateway as of 10 September.

-

How Fyxer AI Turned a Boring Problem Into $30M, and What Fintech Founders Can Learn

September 10, 2025Most professionals aren’t drowning in strategy. They’re drowning in emails, meetings, and notes that go nowhere. London-based Fyxer AI spotted that, built a product to.

-

Revolut’s UAE License Approval: Lessons in Expansion for Fintech Founders

September 10, 2025Revolut’s recent success in securing in-principle approval for key payment licenses in the United Arab Emirates (UAE) offers a masterclass in fintech expansion. The London-based.

-

Stripe’s $92B Crypto Bet: Inside the “Tempo” Blockchain

September 5, 2025Stripe, the $92 billion payments giant, has officially unveiled Tempo, a payments-focused Layer 1 blockchain developed with crypto venture firm Paradigm. Unlike most blockchains born.

-

Brex secures EU Payment Institution License via Netherlands. A new chapter in global expansion

September 5, 2025Brex, the San Francisco-based fintech unicorn known for corporate cards and spend management, has secured a Payment Institution (PI) license in the European Union via.

-

Klarna’s Long-Awaited IPO: Lessons for Startup Founders from a BNPL Giant’s Journey

September 3, 2025Klarna Group plc, the Stockholm-founded buy now, pay later (BNPL) fintech, has officially kicked off its initial public offering after a prolonged wait. On September.

-

Klarna x Walmart Canada: What Fintechs Can Learn from This Massive BNPL Rollout

September 1, 2025It’s official: Walmart Canada is now Klarna’s largest omnichannel retail partner in the country. With over 400 stores going live, customers can now use Buy.

-

Chift: Building Europe’s Financial Connectivity Layer

August 26, 2025Europe’s financial software stack is highly fragmented. In the U.S., a startup might integrate with QuickBooks and Xero and be ready for launch. In Europe,.

-

Monzo’s MVNO Move: What Fintechs Can Learn About Diversification

August 18, 2025Monzo is stepping outside of banking and into mobile. The UK challenger bank announced plans to launch an MVNO (mobile virtual network operator), offering customers.

-

What Revolut’s Auditor Switch Teaches Fintech Founders About Scaling Into Regulated Markets

August 11, 2025Revolut – widely recognized as the UK’s top fintech unicorn – has appointed Ernst & Young (EY) as its new global auditor, replacing its long-term.

-

Why Fintechs Can’t Ignore Osborne’s Call on Crypto and Stablecoins

August 5, 2025Former UK Chancellor George Osborne, now an advisor to Coinbase, recently said for the Financial Times that the UK has already missed its first chance.

-

What Fintech Startups Can Learn from Airwallex UK’s 109% Growth

August 5, 2025Another fintech darling just smashed triple-digit growth, but what’s actually under the hood? Airwallex UK reported a 109% YoY revenue increase for the first half.

-

Inside Ramp’s $500M Raise: Strategic Lessons from a $22.5B Fintech Valuation

August 4, 2025Ramp, the NYC-based spend management fintech, has pulled off a rare feat in a sluggish funding market: two major raises in 45 days. After raising.

-

Revolut’s Rumored U.S. Bank Buy: Shortcut to Expansion or Risky Bet?

July 31, 2025British fintech powerhouse Revolut is reportedly considering a shortcut to crack the American market; buying a U.S. bank outright. The idea? Acquire a small, federally.

-

Mastercard Just Scaled a B2B Painkiller – Here’s Why Fintech Should Care

July 30, 2025If you’ve ever worked on the supplier side of B2B payments, you know the pain: virtual cards promise fast payments, but processing them is tedious..

-

Going Global Without Giving Up Control: Playbook from Wise

July 29, 2025Wise just made a bold move. The UK fintech announced it’s shifting its primary listing to the U.S., while also extending its dual-class share structure.

-

Monzo’s £21M Fine: A Lesson in Compliance for Fintech Startups

July 28, 2025When one of the UK’s best-known digital banks gets fined £21 million, the fintech world pays attention. That’s exactly what happened to Monzo after regulators.

-

When Your Data Isn’t Really Yours: What JPMorgan’s Move Means for Fintechs

July 28, 2025Jamie Dimon just reminded fintechs who’s in charge of the pipes. JPMorgan Chase is preparing to charge fintech firms like Plaid and Intuit for access.

-

Brazil’s Pix System Is Booming. What Europe Can Learn?

July 1, 2025Brazil’s Pix has quietly become one of the most successful fintech stories on the planet. And no, it’s not a startup. It’s a public instant.

-

Why Sweden Barely Uses Cash.. and What That Means for the Rest of Us

July 1, 2025How Sweden quietly became a real-time payments pioneer. Sweden didn’t hold a flashy press conference announcing the death of cash. It just kind of… stopped.

-

What If You Never Raised a Dime? Fintechs Built Without VC

June 27, 2025For all the pitch decks, demo days, and “warm intros”, it’s easy to forget one thing: You don’t have to raise venture capital to build.

-

KPIs That Actually Matter for Fintech Startups in 2025

June 27, 2025Fintech founders: the right metrics can make or break you. In 2025, growth and retention aren’t just buzzwords – they’re survival. Track what matters and.

-

Unicorns Are Rarer in 2025. Should You Even Want to Be One?

June 27, 2025Fintech startup founders will remember the glory days of 2021 when unicorn fever was at its height. Back then, sky-high valuations and cheap capital created.

-

Fintech Gets Strategic Backing in the UK Government’s 10-Year Plan for Growth

June 26, 2025The Industrial Strategy is a 10-year government plan to boost investment and grow future industries in the UK. It promises to make it easier and.

-

Building Trust in Web3? MoonPay Has a New Playbook

June 25, 2025Web3 feels like a wild west of projects and protocols. Newcomers and veterans alike often struggle to figure out which decentralized apps (dApps) or platforms.

-

GENIUS Act passed: a big win for stablecoins. But what now?

June 18, 2025The U.S. Senate has passed the bipartisan GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) by a 68–30 vote. This landmark bill creates.

-

Inside Visa Flex: One card, real-time choices, and a new way to pay

June 18, 2025There’s been a major shift happening in payments; and it’s not another crypto thing. Instead, it’s something deceptively simple: letting people choose how they want.

-

Banking Apps Are Too Passive. Revolut’s AI Wants to Fix That

June 18, 2025If you thought AI in banking was all hype and no substance, Revolut wants to change your mind — starting with an in-app assistant that.

-

Are Amazon and Walmart About to Launch Their Own Stablecoins?

June 17, 2025They’re not printing money (yet). But they’re inching toward a future where they might not need banks — or even Visa. Multiple reports now suggest.

-

Ramp’s Playbook: Scale Fast, Burn Slow, Raise Big

June 17, 2025Ramp is reportedly raising around $200 million at a $16 billion valuation — just three months after a $13B secondary sale. For those keeping score,.

-

Launched in 2024. Gaining Ground Fast. Here Are 5 Fintech Startups Doing It Right

June 17, 20252024 gave us a fresh wave of fintechs that didn’t bother waiting in line. They launched, made noise, and started landing deals before most people.

-

Aspora Scores $53M to Redesign Banking for Global Citizens

June 16, 2025Aspora’s founding team is building cross-border banking tools. The London-based startup just closed a $53 million Series B led by Sequoia and Greylock, with Revolut cofounder.

-

No Pockets? No Problem: The Past, Present, and Future of Palm-Based Payments

June 12, 2025Paying with your hand isn’t science fiction. It’s showing up in stores, stadiums, and train stations around the world. The concept of using your hand.

-

Tebi’s €30M Series B: From Side-Project POS to a Hospitality Fintech OS

June 11, 2025Tebi, an Amsterdam-based fintech startup focused on hospitality businesses, announced a €30 million Series B funding in June 2025 led by Alphabet’s growth fund CapitalG,.

-

Supercharged by Nvidia: Why the FCA’s New AI Sandbox Is a Big Deal for Fintech

June 10, 2025Sometimes regulators get it right. This week, the UK’s Financial Conduct Authority (FCA) quietly did something big. It teamed up with Nvidia to launch a.

-

From Crypto Startup to Wall Street: What Circle’s IPO Teaches Fintech Founders

June 6, 2025In a June 4 press release, Circle Internet Group, Inc. (the fintech behind USDC stablecoin) announced the upsizing of its IPO to 34 million shares.

-

Pricing Made Them, or Broke Them: 10 Real Fintech Stories

June 6, 2025Pricing can make or break a fintech startup. Charge too much or too little, and you might scare off customers or bleed cash. Get it.

-

Fintech’s 3% Market Share Is Growing 3x Faster Than the Entire Industry

June 5, 2025Global fintech is no longer just the bold upstart nipping at the heels of legacy finance. It’s emerging as a disciplined, fast-scaling force with real.

-

Revolut launches its first ATMs. And yes, it’s a big deal

June 4, 2025It finally happened. The world’s biggest branchless bank just did something very… physical. Revolut has launched its first-ever branded ATMs, starting with 50 machines across.

-

€1M Later, Husk Shows Us How to Actually Build a Fintech for Startups

June 2, 2025Imagine you're running a startup. You've just hired a couple of new developers, your marketing budget just tripled overnight, and your cloud bill looks like.

-

Adyen Expands iPhone Checkout to 7 More European Countries

May 29, 2025Adyen just made it even easier to accept in person payments. No terminals. No extra devices. No cables. Just an iPhone. As of May 27,.

-

Could Crédit Coopératif Be Anytime’s Next Home? Talks Are on the Table

May 26, 2025Crédit Coopératif and Orange Bank are officially "seeing each other." At least on paper. The two have entered exclusive talks about a potential deal that.

-

Top 5 Fintechs That Went From “No Thanks” to “Next Big Thing”

May 26, 2025If you’re building a fintech startup, chances are you’ve heard some polite version of “Not sure there’s a market for this” or “Sounds risky.” Most.

-

Monarch Just Turned the Fintech Freeze Into a $75M Warm-Up

May 26, 2025Monarch has raised $75 million in Series B funding, one of the largest consumer fintech rounds in the U.S. this year so far. The company.

-

Startup Affiniti Thinks Your Next CFO Might Be a Bot

May 25, 2025Most fintech tools weren’t built for your local auto shop. Affiniti is changing that. Founded in 2021 by Aaron Bai and Sahil Phadnis while they.

-

Story of Chime: Not a Bank, But Better (Except When It Wasn’t)

May 25, 2025Chime launched in 2012 with a simple premise: what if people actually liked their bank? Founded by Chris Britt and Ryan King, Chime offered a.

-

New UK rules ahead for Klarna and BNPL players

May 25, 2025Big changes are coming for Buy-Now, Pay-Later (BNPL) in the UK. Earlier this month, HM Treasury announced that the days of BNPL operating like the.

-

Airwallex Raises $300M at $6.2B Valuation: How a Cross-Border Fintech Took Off

May 24, 2025Singapore-based Airwallex just raised a fresh $300 million in Series F funding, bringing its total capital to over $1.2 billion and boosting its valuation to.

-

Wero and Revolut? No Statement Yet. But the Pieces Fit.

May 24, 2025A fresh round of buzz is making its way through the European payments world; and it’s not just about another product launch. According to exclusive.

-

Story of Wise: Wanted Fair Rates. Oops, Built a Fintech Empire.

May 22, 2025Wise (formerly TransferWise) is one of those rare fintechs that didn’t just chase hype but built something genuinely useful. Founded in 2011 by two Estonian.

-

Visa’s New Program Could Save Fintechs Months of Setup

May 22, 2025Visa has launched a new program to make life easier for financial institutions and fintechs looking to work more closely together. Announced on May 21,.

-

U.S. Stablecoin Bill Advances: What Fintech Founders Need to Know

May 21, 2025The United States is making a move toward serious digital asset rules with the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins). While.

-

Google’s AI Checkout Shows What Frictionless Really Means

May 21, 2025At Google I/O 2025, the company announced a major upgrade to online shopping: a new AI-driven feature called agentic checkout, part of its broader AI.

-

What Fintechs Can Learn from Ontik, the ‘Stripe for Trade Credit’

May 20, 2025London-based fintech Ontik (founded in 2023) is tackling one of the last manual corners of the economy – trade credit for wholesale merchants. Co‑founders Chris.

-

BBVA and CaixaBank Launch Europe’s First Interbank RTP Transactions: What It Means for Fintech

May 20, 2025Spanish banks BBVA and CaixaBank have completed Europe’s first interbank Request-to-Pay (RTP) transactions. In a live pilot during April and May 2025, the two banks.

-

Revolut Announces €1 Billion France Expansion and Banking Licence Bid

May 19, 2025British fintech Revolut announced at President Macron’s Choose France investment summit that it will invest €1 billion in France over three years and apply for.

-

AI Agents in Payments: Mastercard’s Agent Pay vs Visa’s Intelligent Commerce

May 18, 2025In May 2025, both Mastercard and Visa unveiled AI-driven shopping assistants, marking a new era of “agentic commerce.” Each network’s solution lets digital assistants research,.

-

What Fintechs Need to Know About Mastercard and MoonPay’s Stablecoin Push

May 16, 2025Mastercard and crypto-fintech MoonPay have announced a global partnership to make stablecoin spending as easy as using cash or cards. Under the deal, fintech companies.

-

Klarna’s AI-Driven Restructuring: Lessons for Fintechs