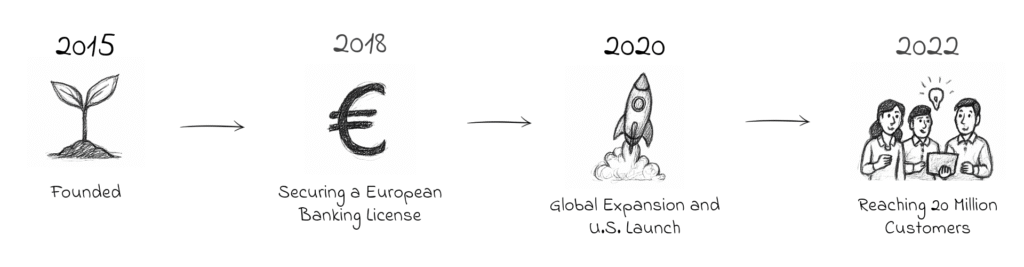

In less than a decade, Revolut has grown from a modest London-based fintech startup into one of the world’s largest and most innovative digital financial platforms. Founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, Revolut set out to make financial services simpler, faster, and more transparent. As of 2025, it serves over 52 million customers in 38 markets and continues to redefine what a digital bank can be.

Early Growth: Filling a Market Gap (2015–2018)

Revolut’s initial offering—a prepaid debit card paired with a mobile app—targeted a clear need: low-cost currency exchange and international transfers. This resonated with expats and frequent travelers. Within a year, Revolut had acquired over 100,000 customers.

By 2018, Revolut had secured a European banking license via the Bank of Lithuania and expanded into cryptocurrency trading, premium subscriptions, and business banking. These moves laid the groundwork for scalable, cross-border financial services.

- 2015–2018: Valuation grew to $1.7B

Scaling Smart: Global Expansion and Diversification (2019–2021)

Between 2019 and 2021, Revolut aggressively entered new markets including the U.S., Australia, Japan, and Singapore. It also diversified its products—adding commission-free stock trading, “Metal” plans, and a growing suite of business financial tools.

Rather than rely on traditional banking income, Revolut implemented a hybrid revenue model based on subscriptions, transactions, and premium services. By 2021, it had over 15 million users and a valuation north of $30 billion.

- 2019–2021: Valuation grew to $33B

Building Infrastructure for the Future (2022–2023)

Anticipating the limits of legacy banking systems, Revolut built a proprietary core banking platform. Its single app adapts dynamically to local regulatory requirements, allowing for faster market entry and a consistent user experience worldwide.

A centralized but locally responsive compliance framework helped Revolut scale securely and efficiently—an advantage over both traditional banks and less disciplined fintechs.

Record-Breaking Results and Expansion (2024–2025)

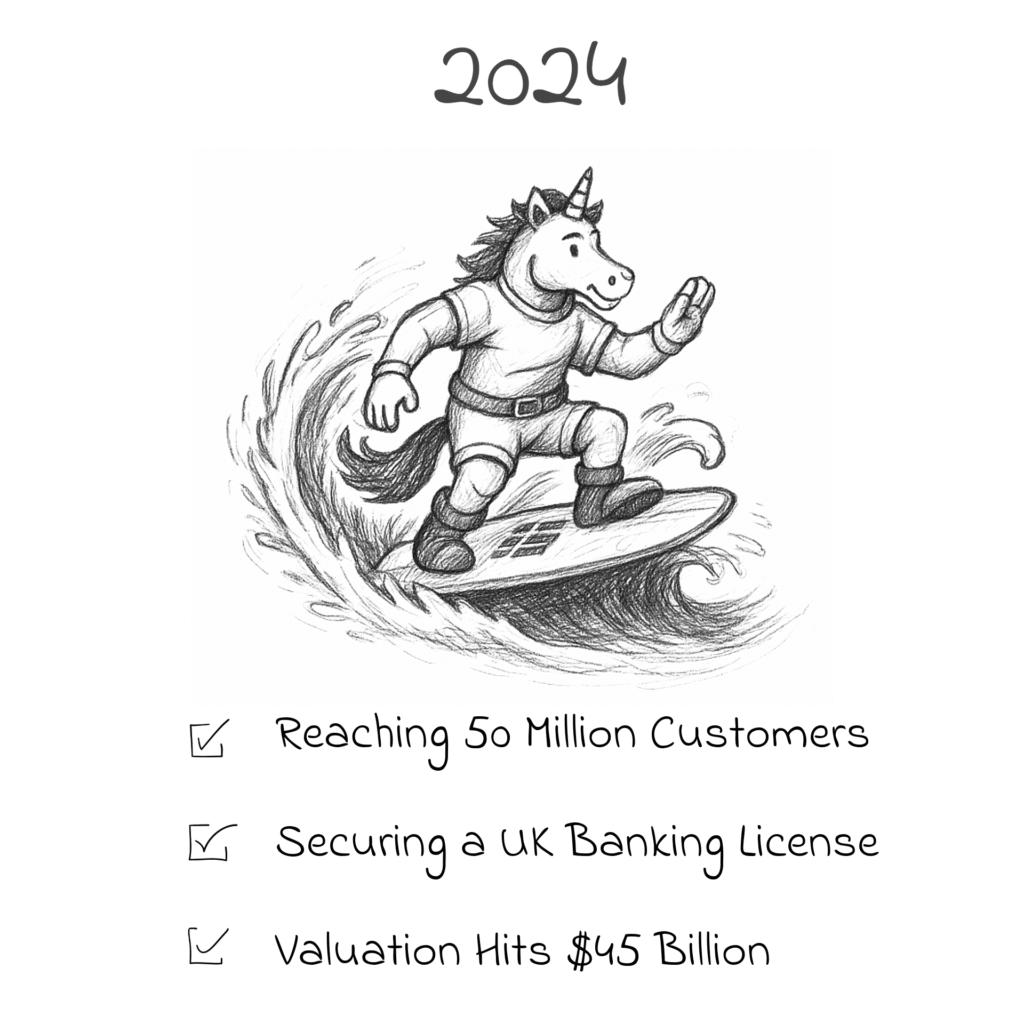

In 2024, Revolut secured a long-awaited UK banking licence, enabling it to offer deposit and credit products in its home market. In 2024, Revolut’s revenue surged 72% to $4.0 billion, while profit before tax rose 149% to $1.4 billion and net profit more than doubled to $1.0 billion, reflecting a significant leap in operational efficiency and profitability.

With a user base exceeding 40 million, Revolut continues to focus on growth over short-term profitability. The company plans to enter mortgage lending in several European countries and expand operations into Latin America, India, and other high-growth regions. With over ten active revenue streams — from payments to trading to credit — Revolut has established itself as a leader among global fintechs.

- 2025: Valuation grew to $48B

How Revolut Turned Strategy into Scalable Success

What really sets Revolut apart is how it turned strategy into action across four key areas—building not just a fast-growing company, but one that’s built to last. These weren’t just big bets—they were smart, interconnected moves that fueled sustainable growth:

Diversified revenue mix

Revolut didn’t rely on a single product or market. By spreading its earnings across subscriptions, card payments, FX, crypto, and wealth services, it built a more stable, resilient business from the ground up.

Global expansion done right

Revolut didn’t just enter new markets—it did so with intention. A lean, tech-first model allowed it to launch in countries like Brazil and New Zealand without the drag of legacy infrastructure.

Innovation with purpose

Every product launch—from eSIMs and RevPoints to Revolut X and Money Market Funds—was tied to a clear customer need or business opportunity. This approach kept users engaged while opening new revenue streams.

Compliance that scales

With tools like the internal “Karma” system, Revolut made compliance everyone’s responsibility. By tying bonuses to risk metrics, it embedded accountability into the culture—and gave regulators one more reason to trust its growth.

These four pillars didn’t just support Revolut’s rise—they shaped a fintech model that others are now racing to follow.

Lessons from Revolut’s Success: Key Factors Behind Its Growth

Revolut’s journey holds valuable insights for fintech startups aiming to scale internationally:

- Clear Product-Market Fit: Targeted specific customer pain points such as expensive currency exchange fees and lack of borderless banking.

- Customer-Driven Innovation: Prioritized product development based on measurable customer impact, rather than internal assumptions.

- Unified Technology Platform: Built one global core banking platform and one app serving all jurisdictions, simplifying operations and speeding market entry.

- Strong Compliance Focus: Embedded regulatory compliance into the business model early, enabling faster and smoother international expansion.

- Revenue Diversification: Moved beyond card transactions to generate income from subscriptions, trading, lending, and other services.

- Efficient Scaling: Maintained a lean cost structure while investing heavily in technology, allowing for sustainable hypergrowth.

- Relentless Global Ambition: Focused on rapid customer acquisition and market expansion rather than early-stage profitability.

For fintech startups, Revolut’s story demonstrates that success depends not only on product innovation but also on regulatory discipline, operational efficiency, and relentless customer focus.

“This performance earned us the status of Europe’s most valuable private technology company, reflecting the confidence of existing and new investors in our trajectory. But we’re just getting started.”

Nik Storonsky, co-founder and CEO of Revolut