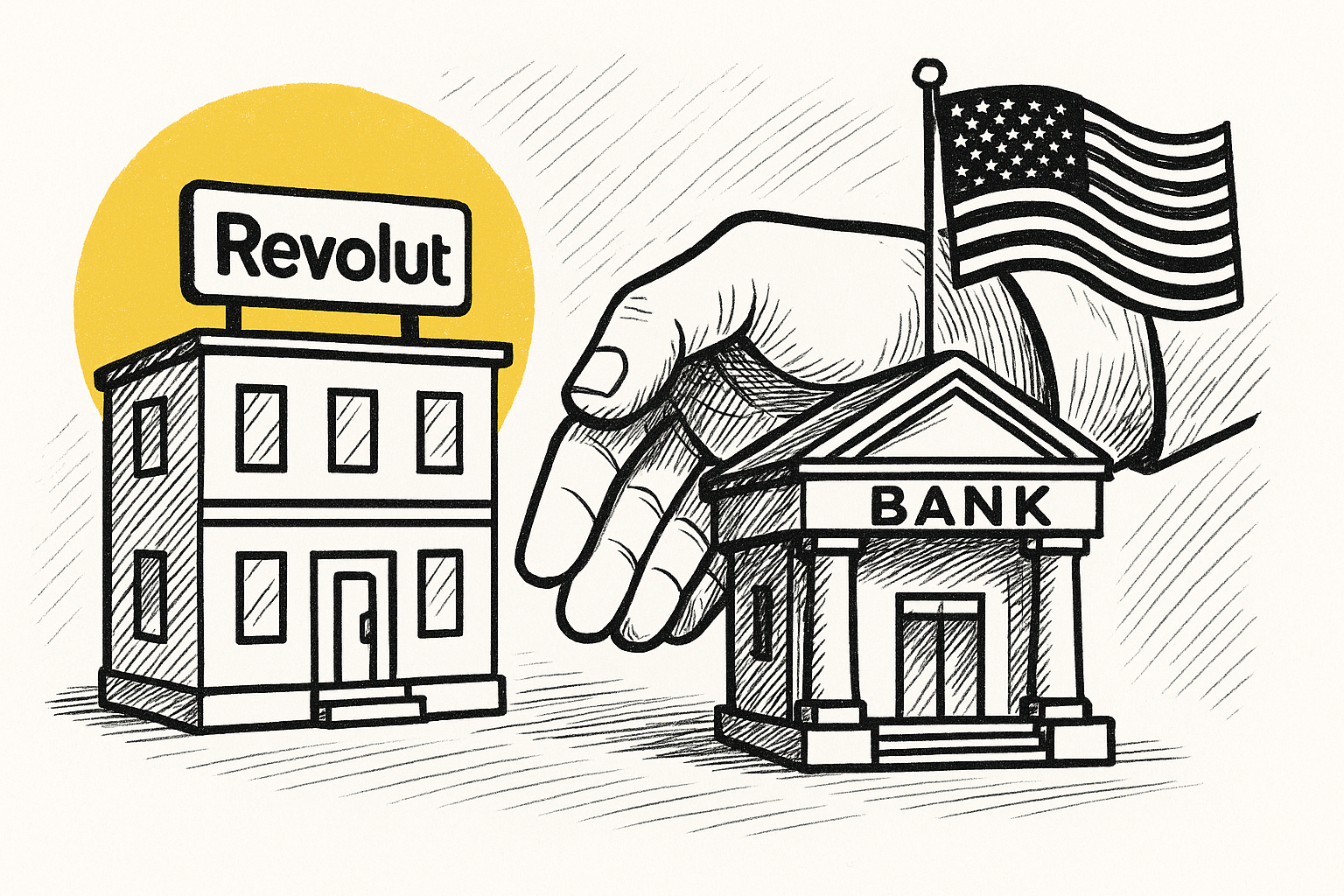

British fintech powerhouse Revolut is reportedly considering a shortcut to crack the American market; buying a U.S. bank outright. The idea? Acquire a small, federally chartered bank and fast-track access to a national banking licence. That would let Revolut skip the long, painful process of applying for one from scratch, and start offering lending and deposit services far sooner.

The company hasn’t confirmed the plan publicly, but insiders suggest it’s under serious consideration. And whether or not it happens, the rumor alone sheds light on a bigger issue: how ambitious fintechs try to break into the U.S. financial system, and what trade-offs they face along the way.

Why buy instead of apply?

Revolut’s interest in an acquisition follows a well-trodden path. Applying for a new U.S. bank charter can take years, with no guarantee of approval. Buying a small national bank with the right licence could shortcut that process, allowing Revolut to enter the market with full deposit-taking and lending authority in place.

It’s not the first time Revolut has taken this kind of approach. It previously acquired an Argentine bank to gain a foothold in Latin America and reportedly considered buying in the Middle East too. The logic is simple: licensing by acquisition can be faster, more predictable, and more scalable than going through regulators from scratch.

Of course, nothing is confirmed. The company is said to be weighing all options — including applying for its own licence — and hasn’t committed to any single path. But even considering the move shows how strategic these choices have become for scaling fintechs.

The upside: speed and control

Buying a bank offers immediate benefits. First, it shortens the go-to-market timeline by potentially years. Second, it gives Revolut full control over its U.S. operations, ending reliance on partner banks. That means owning the customer relationship, setting its own lending terms, and building its tech stack on its own systems.

It also unlocks national reach. A U.S. national bank charter covers all 50 states, avoiding the licensing maze that haunts most non-bank fintechs. And by inheriting an operating bank, Revolut could sidestep the steepest part of the regulatory learning curve — at least on paper.

Some fintechs have already taken this path successfully. SoFi, for instance, became a bank through acquisition, giving it access to cheaper funding and new revenue streams. For Revolut, the attraction is obvious: faster expansion and less regulatory red tape.

The catch: regulators and reality

Acquiring a bank doesn’t mean regulators will roll over. U.S. authorities would still need to approve the deal — and they’ll likely scrutinize Revolut’s governance, risk controls, and compliance culture before doing so. The fact that Revolut has had regulatory speed bumps in the UK might complicate the picture.

Even if the deal is approved, ownership comes with strings attached. A regulated bank must meet strict oversight standards: capital buffers, compliance exams, and conservative risk management. That’s a far cry from the move-fast culture most fintechs are used to.

Revolut has acknowledged this trade-off publicly. Internally, it’s been trying to build a more mature compliance framework and operational backbone. It’s also been hiring senior banking talent in key markets — a smart step, and one that shows it knows what it’s signing up for.

Still, the question remains: can a tech company act like a bank without losing its edge?

What fintech founders should take away

For fintech startups eyeing global growth, Revolut’s case is a useful lens. It highlights that market entry is not just about product—it’s about licensing, regulation, and execution.

Acquisition can be a fast, bold move. But it comes with a heavier burden, and it’s not a silver bullet. Founders need to think beyond access and ask: are we ready to own the infrastructure, the scrutiny, and the compliance culture that come with being a real bank?

Key takeaways for fintech startups

Here’s what Revolut’s U.S. strategy can teach growing fintechs:

- Licensing is strategic, not just procedural. Decide early how you’ll get regulated — by applying, partnering, or acquiring.

- Buying a bank can be faster — but costly. If you have capital and clarity, an acquisition can cut years off your roadmap.

- Compliance maturity is non-negotiable. If you want to run a bank, build like a bank: with controls, oversight, and experienced leadership.

- Don’t lose your tech DNA. Becoming a bank doesn’t mean abandoning speed. It means finding a way to scale responsibly.

- Align your licence with your model. A charter is a tool. Make sure it supports your product roadmap and revenue strategy — not just your press release.

Your Fintech Story helps ambitious fintechs grow, scale, and navigate complex markets. Reach out if you’re ready to take the next step.