Tapi, a Latin American paytech founded in 2022, announced a $27 million Series B round led by Kaszek, with participation from Endeavor Catalyst and Latitud. The new capital brings Tapi’s total funding to more than $60 million raised since 2022 and positions the company to deepen its focus on payments and collections infrastructure in Mexico and wider Latin America.

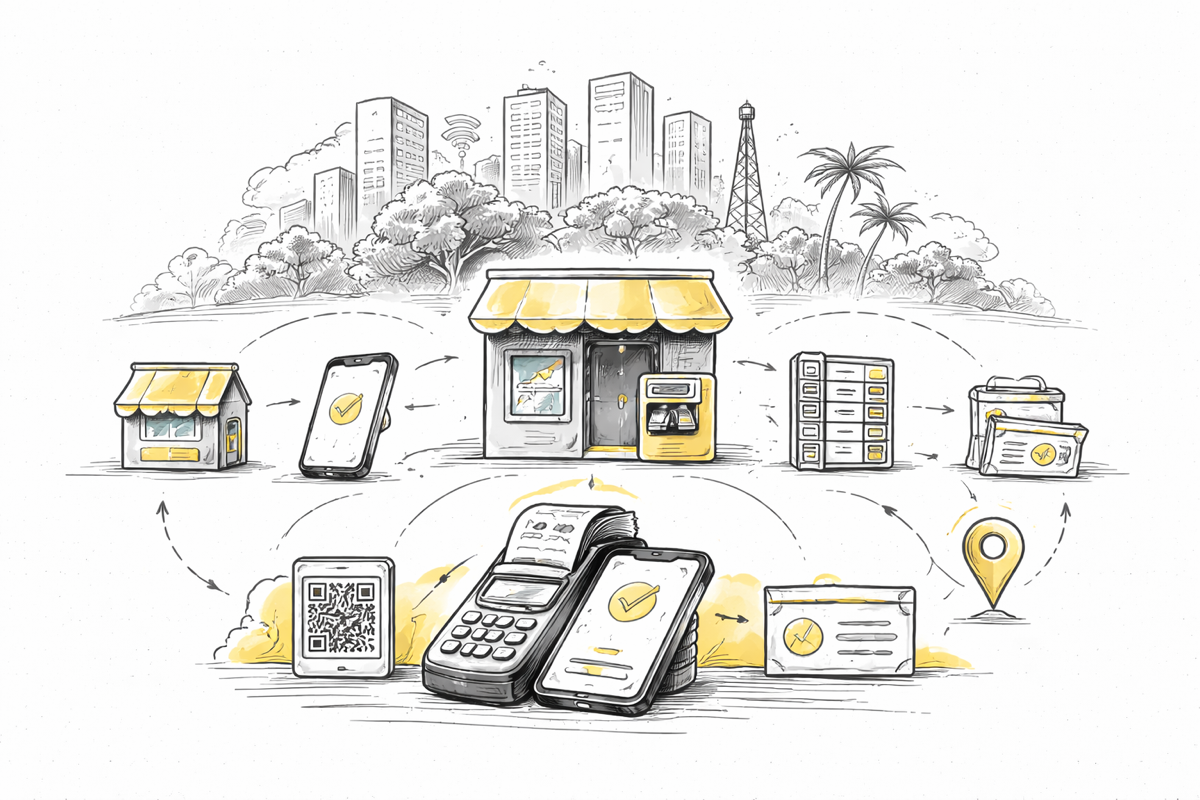

Tapi builds one of the region’s largest payments networks, connecting both digital and physical payment channels through a single API. Its infrastructure lets banks, fintechs, billers and other businesses process recurring service payments, cash in and cash out, airtime top-ups and gift card transactions. Today the network processes more than 250 million transactions a year with over $6 billion in volume, and connects 20,000 service providers and roughly 70,000 physical points of service across Mexico, Argentina, Chile, Colombia and Peru.

Growth and Momentum Behind the Round

2025 was a defining year for the company. Tapi’s revenue grew significantly, it reached profitability, and it completed a strategic acquisition of the assets of Arcus in Mexico. That combination of growth and operational milestone helped attract new capital and reinforced confidence in the company’s strategy.

A standout part of Tapi’s business is tapipay, a collection and billing platform designed for businesses with recurring payment needs. Organizations such as small and medium enterprises, financial services companies, insurers and utilities can automate their billing and collections through a single integration that connects all major payment methods. This simplifies reconciliation and reduces the operational burden of managing multiple payment channels.

Mexico remains at the center of Tapi’s expansion plans, accounting for the majority of its business activity. The Series B funds are earmarked to strengthen technology, expand payment and collection capabilities, and grow the company’s technical team, which already represents more than 70 percent of its workforce. Tapi also intends to continue scaling its presence in countries where it already operates, supporting banks, fintechs and service providers with broader ecosystem integrations and growth.

Key takeaways for fintech startups

A few observations stand out for founders building in similar spaces:

- Infrastructure remains critical in markets where digital and physical payments coexist at scale.

- Profitability and operational execution strengthen the fundraising story.

- Solutions that support recurring revenue and automated billing resonate with enterprise customers.

If you are building or scaling a payments-focused fintech and want to clarify your positioning or fundraising narrative, feel free to contact us to discuss how Your Fintech Story can help.