Jelou, a company building transactional AI inside messaging apps, announced a $10 million Series A round to accelerate product development and international expansion. The round was led by Wellington Access Ventures, with participation from Krealo and Collide Capital.

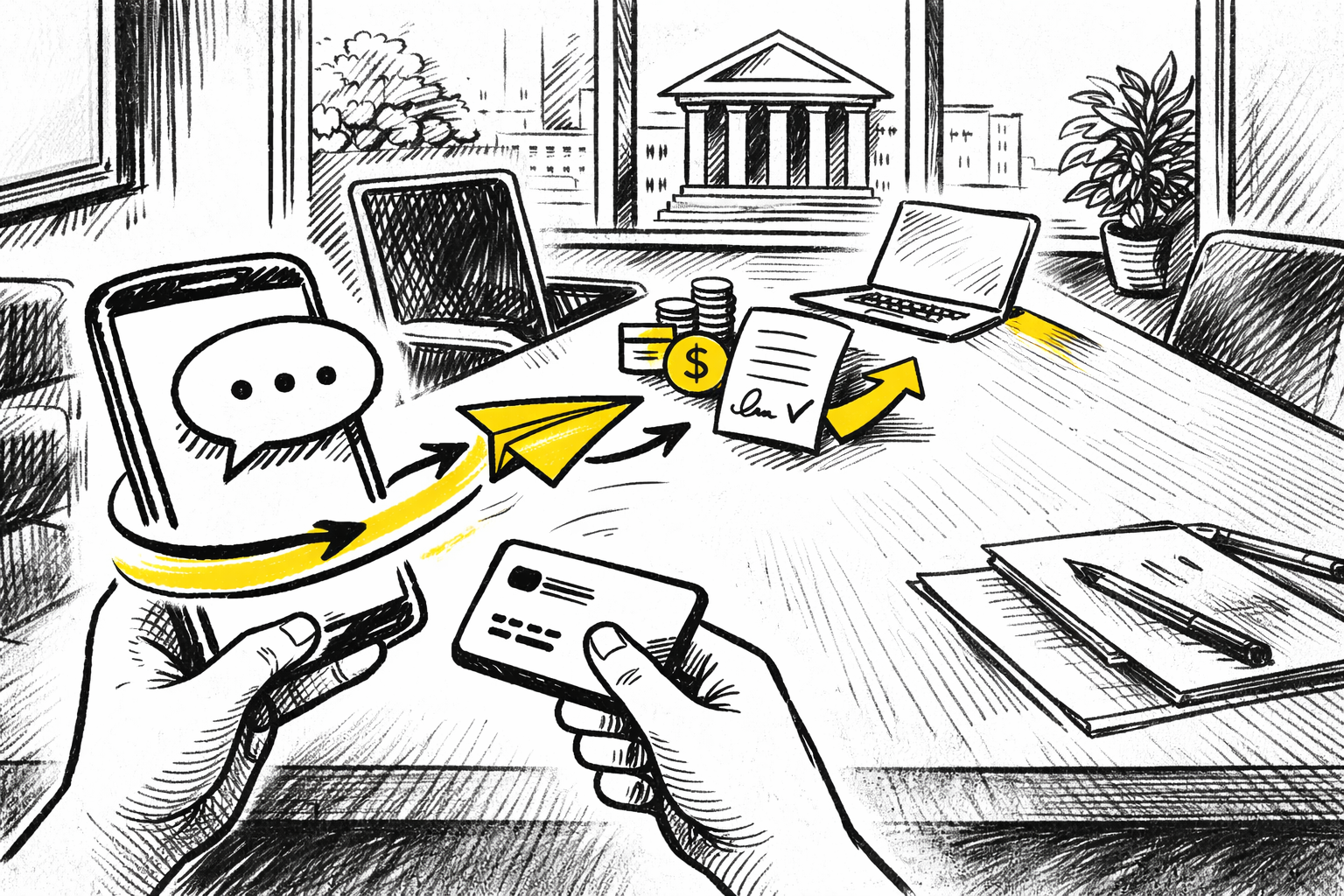

The company’s premise is straightforward. People already communicate with businesses through chat. Instead of redirecting users to external apps or web forms to complete financial actions, Jelou enables those actions to happen directly inside a conversation on WhatsApp. Payments, identity checks, contract signatures, and credit applications remain within the same chat thread.

That shift matters in regions where messaging apps are the primary digital interface. Jelou points out that a significant share of transactions are lost when users are pushed outside the chat environment. The product is designed to reduce that friction.

A Platform Built for Real Operations

Jelou positions its Brain OS as more than a chatbot layer. The platform connects AI agents directly to enterprise infrastructure: banking cores, payment processors, identity providers, ERP systems, and internal databases.

The goal is to automate real workflows, not just answer questions. A user can apply for a financial product, complete verification, and finish the process without leaving the conversation. For regulated industries, this means conversational interfaces that still comply with operational and security requirements.

At the time of the Series A, Jelou was active in more than a dozen countries and serving over 500 corporate clients. Its customers include major banks and large consumer brands across Latin America. The company reports having processed over $100 million in financial products through these in-chat flows.

Why Investors Care

Investor interest reflects confidence in this architecture. Jelou combines conversational AI, voice interfaces, payments, and identity into a single layer that companies can adopt without rebuilding their existing systems.

For enterprises, that matters. Messaging is already where customers are. Jelou’s value proposition is not about replacing core systems, but about making them accessible through a familiar interface. The platform acts as connective tissue between complex back ends and simple conversations.

This framing positions Jelou less as a chatbot vendor and more as infrastructure for “conversational operations.”

Expansion After the Round

The new capital is allocated to scale Brain OS and expand geographically. Jelou plans to open offices in Mexico and Colombia, deepen its presence in Peru, and begin entry into Brazil and the United States.

The company was founded in Ecuador in 2017 by Luis Loaiza and Alberto Vera. It started with basic conversational tools and evolved toward secure, transaction-ready AI. The Series A reflects that transition: from experimentation with chat interfaces to building a platform capable of handling regulated financial flows at scale.

Key takeaways for fintech startups

Jelou’s trajectory shows what was in place before the $10M round:

- A product that embeds financial operations directly inside messaging apps.

- More than $100 million processed through conversational workflows.

- A customer base of over 500 companies, including large banks and brands.

- Deep integration with enterprise and financial infrastructure.

For fintech teams exploring conversational interfaces, Jelou offers a concrete example of moving beyond chat as support and into chat as execution.

If you’re thinking about how distribution, UX, and regulated workflows intersect in your product, Your Fintech Story can help you shape that strategy and avoid expensive detours.