Klarna announced it is backing Google’s Universal Commerce Protocol, known as UCP. The goal of UCP is to create a shared way for AI agents, merchants and payment systems to work together across discovery, checkout and post-purchase interactions inside AI-powered flows.

Klarna has already supported Google’s Agent Payments Protocol and works with Google Pay, Google Store, Google Play and Google Cloud. Supporting UCP extends this cooperation into a broader standard for how commerce can function when AI agents are part of the transaction path.

UCP aims to standardize how commerce systems communicate

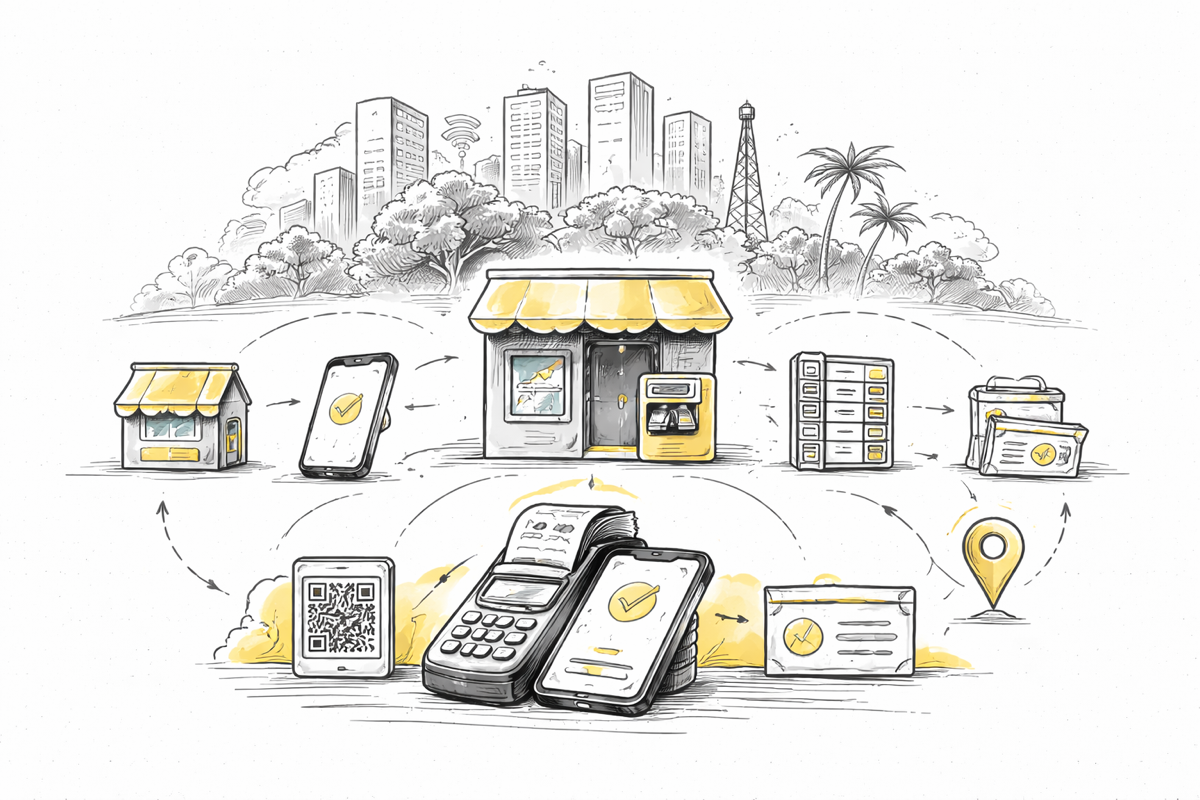

Universal Commerce Protocol is an open standard. It defines a common framework for commerce events and data exchange between agents, sellers and payment services.

Instead of building custom integrations for every platform, merchants and payment systems can connect once and become compatible with any agent or interface that follows the protocol.

In practice, this allows an AI agent to help a consumer find a product, complete checkout and handle follow-up interactions without the user moving across multiple apps or websites.

For businesses and payment providers, a shared protocol can reduce integration effort and make it easier to support new environments where transactions take place.

Why Klarna is interested in this direction

Klarna stated that its payment and decisioning systems are already used by millions of consumers. Through UCP, the company wants these capabilities to be available inside AI-led commerce journeys.

Klarna also highlighted interoperability, security and transparency as important requirements if AI-driven commerce is going to scale in a way that works for both merchants and consumers.

This reflects a view that the interface where customers complete purchases may increasingly be an AI agent rather than a traditional website or app.

Broader industry involvement

Google developed UCP with contributions from companies including Shopify, Etsy, Wayfair, Target and Walmart. These companies are participating in shaping the protocol.

Their involvement shows that large retailers and commerce platforms are preparing for a model where AI agents play a central role in how customers discover products and complete purchases.

For payment providers, this means preparing for transactions that occur inside agent environments, not only inside standard checkout flows.

Key takeaways for fintech startups

Several practical signals emerge from Klarna’s support of UCP:

- AI agents are being treated as future commerce channels

- Open protocols may reduce the need for bespoke integrations

- Payments will need to function inside agent-driven interactions

- Interoperability, security and transparency are being emphasized

- Major commerce platforms are aligning around this protocol

If you are building in payments or commerce, this development is worth close attention.

If you want help thinking through how changes like this affect your roadmap and product decisions, contact us.