Tebi, an Amsterdam-based fintech startup focused on hospitality businesses, announced a €30 million Series B funding in June 2025 led by Alphabet’s growth fund CapitalG, with participation from Index Ventures. Coming just months after its Series A, this round brings Tebi’s total funding to €56 million.

The investment signals strong confidence in Tebi’s vision to modernize hospitality operations, and it sets the stage for the startup’s expansion into the UK and other European markets. In an industry often dominated by fragmented point solutions, Tebi’s back-to-back funding rounds underscore the market’s appetite for an all-in-one financial operating system for restaurants, bars, and cafes.

The raise, led by a high-profile investor, also highlights the company’s deep fintech roots: Tebi’s founder Arnout Schuijff is no stranger to fintech success, having previously co-founded Dutch payments giant Adyen.

Origins: A Side Project Born in a Bar

Tebi’s story has unconventional roots, starting not in a boardroom but in a bar.

In 2012, Arnout Schuijff built a simple point-of-sale (POS) app for his friend’s bar, which at the time was still using pen-and-paper to log sales. This quick hack – described by Schuijff as a “charmingly bare-bones” system – was a humble solution to help with basic sales tracking and tax reporting.

In fact, the makeshift app proved surprisingly enduring: the bar relied on it for over a decade, even working around its quirks (one infamous 2018 bar tab grew so large it would crash the app if opened, so staff wisely left it untouched).

For years, the project remained a personal side gig while Schuijff was busy building Adyen into a $60+ billion fintech firm.

Fast forward to the COVID-19 lockdown, and Schuijff found himself drawn back to this side project with fresh eyes and new tech tools. He began upgrading the app’s design, accounting logic, and architecture in his spare time, and realized his pet project had the potential to be something much bigger.

What started as a favor to a friend hinted at a broader opportunity: many hospitality businesses were struggling with outdated, fragmented systems. Sensing this gap, Schuijff decided to take the leap. In 2021, he stepped down from his role at Adyen to focus on Tebi full-time, ready to turn the long-running side project into a standalone company.

(And yes, the irony, as Schuijff later joked, is that the coding project which lured him out of retirement now requires him to do more CEO work than programming.)

He wasn’t alone in this venture: Schuijff teamed up with Rob Vonk, Adyen’s former EVP of Technology, as co-founder and CTO, and even brought in one of the original bar owners as a co-founder, cementing Tebi’s origins in real-world hospitality pain points.

Building a Unified Operating System for Hospitality

From those modest beginnings, Tebi evolved into what it calls a “complete financial operating system” for hospitality businesses.

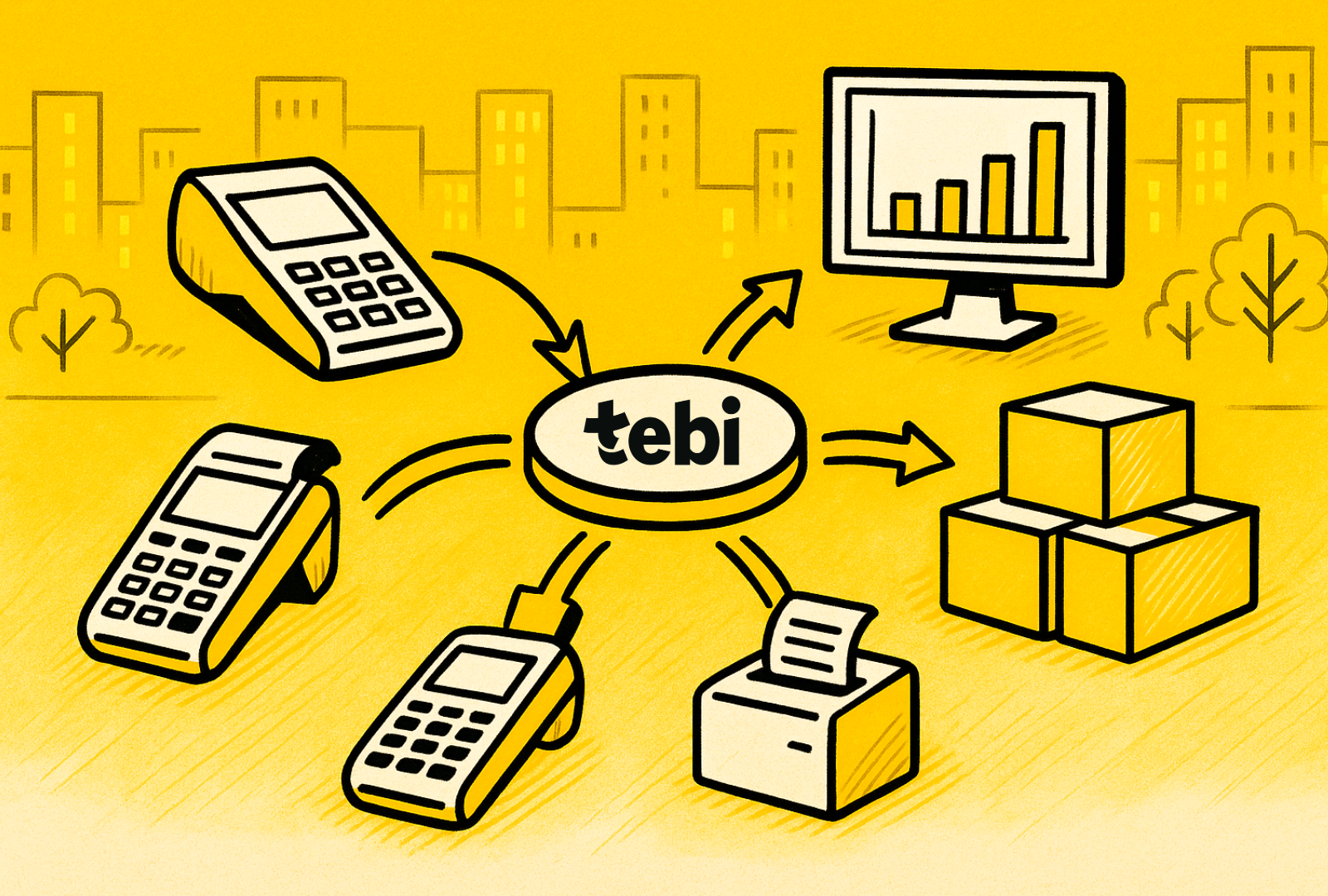

The platform has grown far beyond a simple POS app, now offering a suite of integrated tools under one umbrella. Tebi’s all-in-one system covers point-of-sale, payments, kitchen display screens, table reservations, inventory management, online ordering (QR ordering), and even bookkeeping.

In other words, it aims to replace the patchwork of separate apps and manual processes that a typical restaurant or bar might use, by providing everything in one coherent package.

“Hospitality owners don’t open their doors because they love integrating five different software systems or wrestling with manual inventory counts at 2 AM,”

– Arnout Schuijff, founder and CEO of Tebi

Yet until now, many restaurateurs have had to do exactly that: juggling disconnected POS terminals, card readers, reservation logs, and accounting spreadsheets.

Tebi’s strategy is to unify these fragmented workflows. The company deliberately uses the term “operating system” to convey that breadth: Tebi’s software is architected to handle front-of-house sales and payments as well as back-of-house operations and accounting, all in sync.

This unified approach is offered on a subscription basis, targeting independent hospitality owners who need enterprise-grade capabilities without enterprise complexity.

By bundling multiple functions together, Tebi is betting it can streamline operations and eliminate the “operational chaos disguised as solutions” that comes from too many siloed tools.

Importantly, Tebi’s platform is built around a real-time financial backbone – essentially treating every sale or expense entry as part of a live narrative of the business’s finances.

That means when a bartender closes a tab or a cafe logs a supply delivery, the system instantly reflects those changes across inventory, revenue, and bookkeeping records. This stands in contrast to legacy hospitality systems (and clunky end-of-day reconciliation rituals) that often leave owners flying blind until after close-of-business reports are run.

The Tech Backbone: Subledgers and Real-Time Accounting

Behind the scenes, Tebi’s distinguishing innovation is its “subledger” architecture.

In plain terms, the software doesn’t just maintain one monolithic ledger for all transactions; instead, it creates many independent but communicating ledgers for different aspects of the business.

Each of these subledgers can scale from handling a single invoice to the volumes of an enterprise, yet they all sync up in real time.

This design, inspired by Schuijff’s deep payments background, is more than just a nerdy engineering feat – it’s the key to delivering the snappy, real-time experience that modern hospitality operators need.

With this infrastructure, every transaction is recorded and posted instantly across the system, enabling on-the-fly financial reporting and reducing the need for tedious manual reconciliations.

Schuijff actually drew on ideas from his past work building Adyen’s internal accounting platform (and even earlier, at a payments startup called Bibit) when crafting Tebi’s core ledger logic.

But he also had new technology at his disposal: by 2020, cloud streaming tech allowed Tebi to support instant transaction updates across its modules – a capability that “grabbed him” and validated that the time was right to bring this concept to market.

In essence, Tebi’s subledger system means a restaurant’s point-of-sale, inventory, and accounting ledgers are all one and the same, just viewed through different lenses.

This real-time accounting backbone is a major technical differentiator for Tebi, one that the company says enables hospitality operators to get immediate visibility into their tax obligations, cash flow, and performance metrics without waiting for nightly batches or manual data entry.

AI-Powered Onboarding and Workflow Automation

In addition to clever accounting architecture, Tebi is also embracing artificial intelligence to remove friction in day-to-day operations.

A core use case is AI-driven onboarding: setting up a new restaurant on a POS system can traditionally take hours or days of configuration, but Tebi aims to get businesses up and running in minutes by letting AI handle much of the heavy lifting.

This might include intelligently ingesting menu data, auto-configuring tax rates, or learning from the business’s patterns to suggest optimal settings.

Beyond onboarding, Tebi is weaving AI throughout its platform to anticipate needs and automate routine tasks.

For example, the system could potentially flag when inventory for a popular dish is running low and prompt an order, or automatically categorize expenses and sales in the books – reducing the drudgery that often falls on owners after closing time.

The goal is not AI for AI’s sake, but to eliminate decades-old pain points: many hospitality owners wear multiple hats, and intelligent automation can give them back precious time.

By surfacing insights in real time (think trending menu items or anomalous costs) and handling repetitive workflows, Tebi’s use of AI aims to let proprietors focus more on the craft of hospitality and less on back-office busywork.

In a sector where tech adoption has lagged and many processes remain manual, these kinds of AI enhancements could be a game-changer for user experience.

Traction at Home and Plans Abroad

Tebi’s integrated approach appears to be resonating in its home market. In the Netherlands, where the startup first rolled out, merchants are already processing “nine figures” (hundreds of millions) in annual payment volume through Tebi.

This early traction – achieved with a deliberately local focus – provided proof of concept that hospitality businesses would entrust their daily operations to an upstart platform.

Having built a solid base in the Netherlands, Tebi is now turning to expansion. The company announced it is entering the UK market in 2025, with an eye on other European markets to follow.

The fresh Series B funds will fuel this expansion and the scaling of its team and infrastructure.

Market timing seems favorable. European hospitality SMEs have long been stuck with either old-school cash registers and bank card terminals or a patchwork of software, in contrast to the more modern, unified solutions common in the U.S.

In fact, only about 39% of European restaurants use a POS application, versus over 95% in the U.S.

This gap means plenty of venues still need an upgrade, and Tebi is positioning itself as an attractive upgrade path – especially as regulators move toward real-time reporting of sales and taxes, a trend already visible in some countries.

Tebi’s backers at CapitalG explicitly noted that European small businesses are underserved by costly, bank-dominated payment solutions, much like the U.S. market 15 years ago, which signals a ripe opportunity for software-embedded fintech solutions.

Armed with new funding and a reference customer base at home, Tebi is preparing to seize that opportunity abroad.

Team Growth and Leadership Moves

Though Tebi’s product is heavy on tech, the company knows that success in fintech (and in hospitality) requires more than code – it needs operational excellence and industry savvy.

To that end, Tebi has been bolstering its leadership team. In addition to CEO Arnout Schuijff and CTO Rob Vonk – both technologists with deep payments expertise – the startup recently brought on two seasoned executives to drive its next stage of growth.

Aki Tas, formerly head of business strategy and operations at Notion, joined Tebi as Chief Operating Officer in late 2024.

Around the same time, Patrick Studener, who was previously COO at delivery app Wolt and led European expansion at Uber, came onboard as Tebi’s Chief Commercial Officer.

These hires were intentional: after assembling a tech-heavy founding team, Schuijff “leveled out the boat” by adding leaders with complementary skills in product, go-to-market, and scaling operations.

Tebi’s team stands at 35 people currently, with plans to double to ~70 by the end of the year.

The company is hiring across engineering, product, and operations – in both its Amsterdam HQ and its new London hub – to support the anticipated growth.

Building a robust team is a key use of the Series B funds, alongside continuing to refine the product. It’s a classic fintech scaling playbook: secure capital, attract top talent, and expand into new markets.

For Tebi, the emphasis is on assembling folks who understand both cutting-edge software and the grit required in hospitality.

As Schuijff puts it, the mission is to “free every hospitality business owner to focus on what they love most” by taking the tech and admin burdens off their plate.

Key takeaways for fintech startups

Tebi’s journey offers several insights that fintech startup founders can learn from:

- Solve a real pain point you know well. Tebi was born from a very concrete problem: a bar owner drowning in pen-and-paper bookkeeping, and a scrappy solution to fix it. Grounding your product in first-hand pain points can provide a clear mission and product-market fit from day one.

- Be patient and seize the right moment. Schuijff nurtured Tebi quietly for years as a side project. When technology (e.g. streaming for instant data) and market timing aligned, he was ready to spin it out into a company. A good idea may need to incubate until the ecosystem is ripe for it.

- Integrate to differentiate. In an industry full of point solutions, Tebi’s all-in-one approach turned fragmentation into an opportunity. By unifying POS, payments, inventory, and more in one platform, they simplified life for customers and created a stickier value proposition.

- Build technical moats that improve user experience. Tebi’s subledger architecture isn’t just clever engineering: it delivers tangible UX benefits through real-time data and almost zero reconciliation work. Investing in deep tech (payments infrastructure, automation, etc.) can set your product apart in ways customers feel every day.

- Leverage AI where it reduces friction. Rather than AI gimmicks, Tebi applied AI to onboarding and workflow automation to save users time. Fintech startups should deploy AI/ML thoughtfully, targeting tedious or complex tasks (like setup, data entry, anomaly detection) to make the user’s journey smoother.

- Balance your team for the long haul. As Tebi grew, the founders augmented their strengths by hiring experienced operators in strategy, operations, and expansion. For a technical founder, bringing in leaders with complementary skills (and vice versa) can accelerate growth and prevent blind spots as you scale.

- Know your market’s landscape. Tebi identified that European hospitality SMBs were under-served by modern payment tech, a scenario reminiscent of an earlier era in other markets. Understanding the unique gaps in your target region or sector can reveal openings for innovation that larger incumbents overlook.

Tebi’s rise from a pub POS hack to a venture-funded fintech platform illustrates how industry-specific insight, solid engineering, and strategic timing can combine to build something truly impactful.

The company’s story is still unfolding, but it already offers a blueprint for fintech entrepreneurs: stay close to your customer’s real needs, innovate under the hood, and don’t be afraid to rewrite the playbook for a traditional industry.

If you’re a fintech founder with a story to share or lessons to offer, we’d love to hear from you. Reach out to us to explore how we can tell your startup’s story.