In May 2025, both Mastercard and Visa unveiled AI-driven shopping assistants, marking a new era of “agentic commerce.” Each network’s solution lets digital assistants research, recommend and pay for consumer purchases — without manual input. These services promise to let busy consumers delegate shopping tasks to trusted AI, but they take different approaches to security, control and integration.

This article focuses on the newest AI tools released by Visa and Mastercard related to agentic commerce, but we’ll cover other AI tools from these companies in one of the future articles.

Mastercard’s Agent Pay

Mastercard’s program, Agent Pay, is designed for conversational AI platforms. It uses what Mastercard calls “agentic tokens” to secure payments on behalf of users. These are merchant-specific, tightly scoped tokens — an evolution of Mastercard’s tokenization system — allowing AI agents to transact safely without exposing real card credentials.

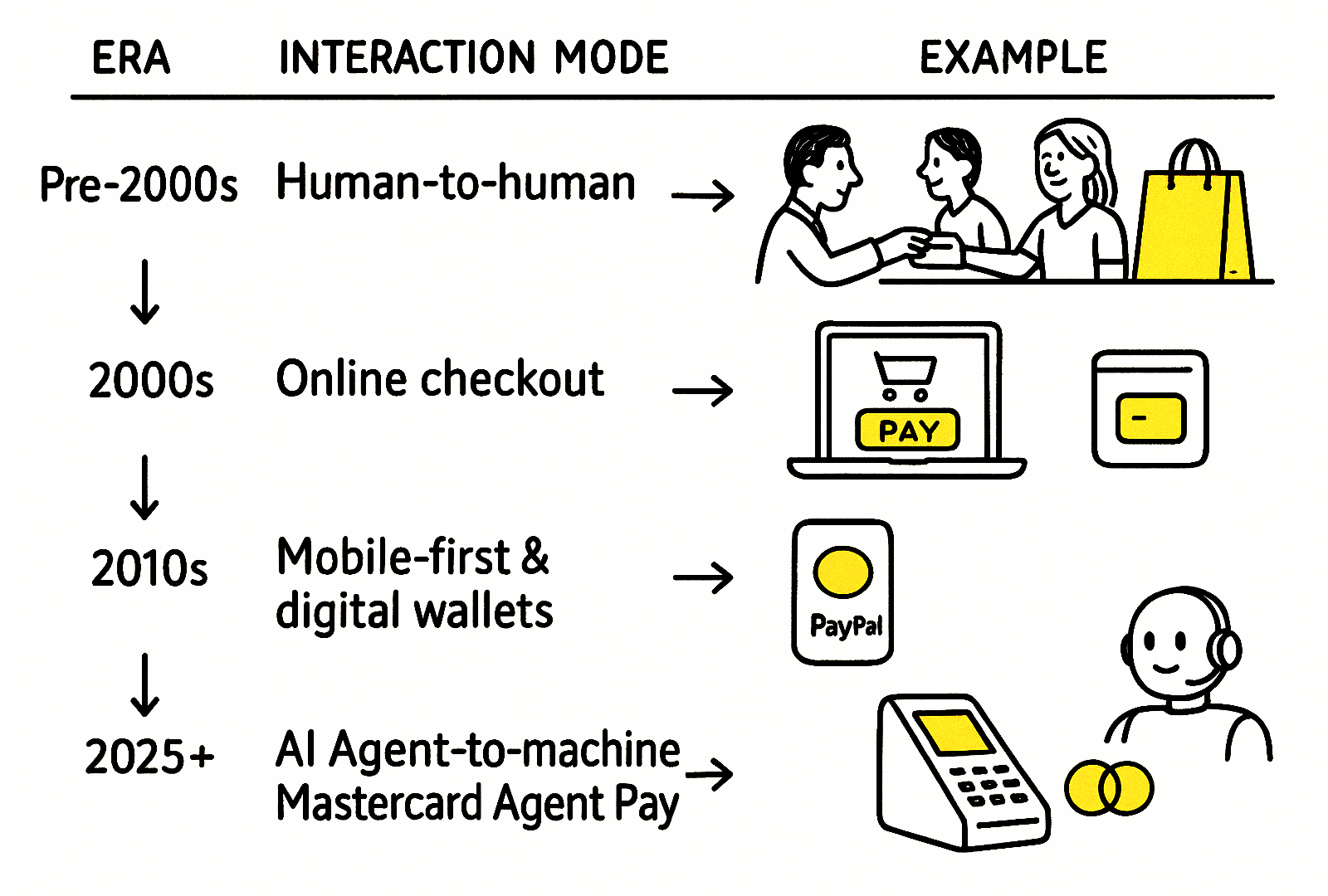

Payment interactions evolved from face-to-face to AI-powered automation.

Security is foundational to Agent Pay. Agents must be verified, transactions are traceable, and users can set granular permissions around what the AI can and can’t do. Mastercard also layers on biometric authentication, fraud monitoring, and dispute resolution. The platform is meant to be embedded directly into chatbots and voice assistants like Copilot or ChatGPT, enabling a seamless flow from recommendation to purchase.

“With the introduction of Mastercard Agent Pay, we’re effectively letting consumers and businesses close the loop. The user can receive recommendations, have tasks completed and make purchases — all in one place.”

– Sherri Haymond, Co-President of Global Partnerships at Mastercard

Visa’s Intelligent Commerce

Visa’s solution, Intelligent Commerce, is built for developers who want to plug AI platforms into Visa’s network. It introduces “AI-ready cards” — tokenized credentials that allow agents to act on behalf of a user without ever seeing the actual card number. These tokens are governed by real-time purchase limits and permissions defined by the user.

Visa’s architecture is more API-driven, designed to integrate broadly with the AI ecosystem. Partnerships with OpenAI, Microsoft, Anthropic, and Samsung suggest a strong push toward embedding payment capabilities into consumer and enterprise AI tools. Like Mastercard, Visa emphasizes user control and data protection, with a delegated authorization model ensuring AI agents act within strict parameters.

Two Different Visions for AI-Powered Payments

Although both Mastercard and Visa launched AI agent capabilities within days of each other, they’re not building the same thing. In fact, they reflect two distinct visions for how AI will interact with the payments ecosystem.

Mastercard’s Agent Pay is about building a seamless experience for end users who rely on AI assistants in their daily lives. It’s designed to fit naturally into conversational tools like Copilot or ChatGPT, enabling those assistants to go from recommendation to purchase — all under strict user-defined rules and secured by a robust tokenization layer. Think of it as giving your digital assistant a wallet and clear instructions on how to use it.

Visa’s Intelligent Commerce, on the other hand, is aimed squarely at the builders — developers and AI platforms that want to embed payment capabilities into their applications. It’s an infrastructure play, offering APIs and “AI-ready” credentials that authorized agents can use to make purchases within defined parameters. Rather than focusing on a specific user interface, Visa is providing the rails for AI-enabled commerce across a broad range of contexts.

So while both companies are enabling AI to transact, their approaches serve different use cases. One is tightly integrated into consumer-facing AI. The other offers flexibility for developers building entirely new AI-driven experiences.

Key Takeaways for Fintech Startup Founders

Agentic commerce is gaining momentum, but Mastercard and Visa are approaching it from very different angles. For fintech startup founders, this divergence offers both strategic clarity and opportunity:

- Two Distinct Visions, Not Competitors: Mastercard is building for consumers through AI assistants like ChatGPT or Copilot. Visa is building for developers, offering infrastructure that powers AI-driven commerce in any app or context.

- Choose Your Integration Path: If your fintech product involves end-user AI interfaces, Mastercard’s Agent Pay model may be more relevant. If you’re creating tools, platforms, or APIs that enable other businesses or apps, Visa’s approach could align better.

- Trust, Tokens, and Control Are Non-Negotiable: Both solutions reinforce the importance of user control, tokenization, and agent verification — expectations your product will also need to meet if it plays in this space.

- This Isn’t Just About Payments: These systems enable AI to drive product discovery, decision-making, and fulfillment — compressing the entire user journey into a single intelligent flow.

- New Value Chains Will Emerge: Think beyond checkout. Agentic commerce creates new points of influence: personalized recommendations, spend orchestration, task automation. Each could be a startup opportunity.

If you’re building or scaling a fintech solution and wondering how technologies like agentic commerce could reshape your roadmap, we’d love to talk. At Your Fintech Story, we help startups navigate complex shifts in strategy, product, and go-to-market. Get in touch today and let’s write the next chapter of your fintech story together.